- Ethereum sees a bit of buying volume after pushing into noteworthy 2024 demand zone.

- Assessing the possibility of a shift from sell pressure to demand.

Ethereum [ETH] bears recently pushed price below $2,400 once again, undoing most of its September gains. This also means that the cryptocurrency is once again trading within its 2024 low range.

A glance at Ethereum price action since the start of 2024 reveals that sub $2,400 prices have historically yielded significant demand. In other words, there is a significantly high chance that ETH may experience a resurgence of demand in the next few days.

ETH exchanged hands at $2,381 at press time, after a 1.34% upside in the last 24 hours. This was after previously experiencing sell pressure for six consecutive days, suggesting that sell pressure might be slowing down.

Source: TradingView

Ethereum may still push lower but the slowdown in sell pressure could give way for a demand comeback. Also note that the current price level is near a major Fibonacci retracement zone which could potentially pave the way for a demand resurgence.

A good time to re-accumulate Ethereum?

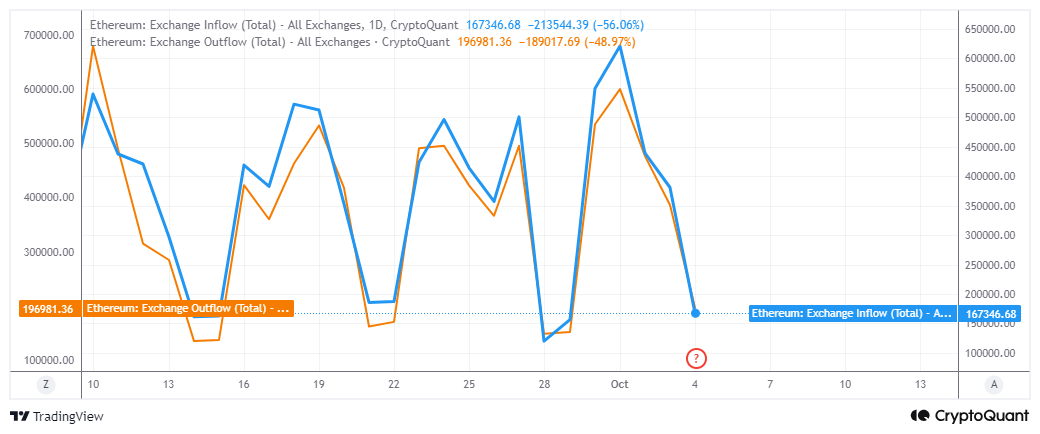

Ethereum on-chain data suggests that accumulation might already be taking place in line with the price chart observations. For example, ETH had higher exchange outflows at 196,981 coins compared to 167,346 coins in inflows.

Source: CryptoQuant

Higher exchange outflows than inflows confirm that buy pressure was higher than sell pressure. This may explain why ETH pulled off a slight uptick in the last 24 hours.

We observed that ETH exchange flows have recently slowed down and are currently at the bottom of their demand and sell pressure swings.

A swing up based on current observations could favor another uptrend. The strength of an uptrend from the latest wave of sell pressure depends on key factors, among them being demand from whales. But just how much Ethereum is flowing into whale addresses?

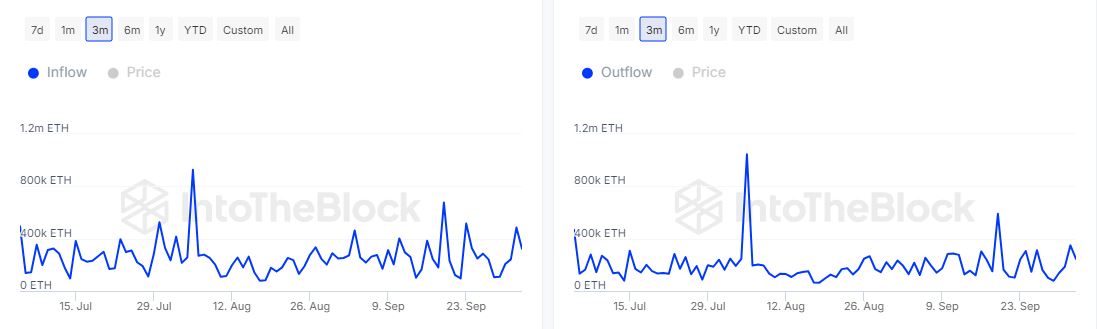

The latest large holder flow revealed healthy whale engagement. A clear gap in the amount of ETH flowing into whale addresses compared to ETH flows out of whale addresses.

Source: IntoTheBlock

Large holder addresses received over 323,000 ETH as of 3 October. On the contrary, large holder addresses registered just over 246,000 ETH outflows.

Read Ethereum’s [ETH] Price Prediction 2024–2025

That was a difference of roughly 77,000 coins, which equated to almost $183 million worth of net buying pressure.

The above on-chain data makes a strong case for Ethereum bulls. However, ETH’s ability to achieve a strong upside during the weekend depends on whether it can attract enough demand.