Ethereum’s (ETH) staking ecosystem has made headlines within the blockchain area for the reason that latest Shanghai improve. Because the crypto market continues to develop, Ethereum has emerged as a market chief in staking, providing among the greatest yields and attracting extra buyers. However what precisely makes Ethereum’s staking so engaging?

Ethereum Staking Goes Large

According to DeFi Ignas, a number one skilled in decentralized finance (DeFi), Ethereum’s ETH has the most effective token economics in crypto. One of many major causes for that is Ethereum’s choice to maneuver away from the Proof of Work (PoW) to a Proof of Stake (PoS) consensus mechanism.

He means that If Ethereum had remained on PoW, $4.7 billion value of ETH would have been issued, greater than the whole market cap of UNI, Uniswap’s native token, at $4 billion. This transfer has made Ethereum provide deflationary, making a extra invaluable asset for buyers.

Nevertheless, as DeFi Ignas factors out, Ethereum’s staking ratio at present stands at simply 14.8%, the bottom amongst main blockchains. That is regardless of providing a aggressive ~4.5% APR. One purpose for this low staking ratio is that different blockchains have a extra concentrated token distribution, with insiders, staff members, and early buyers actively staking for rewards.

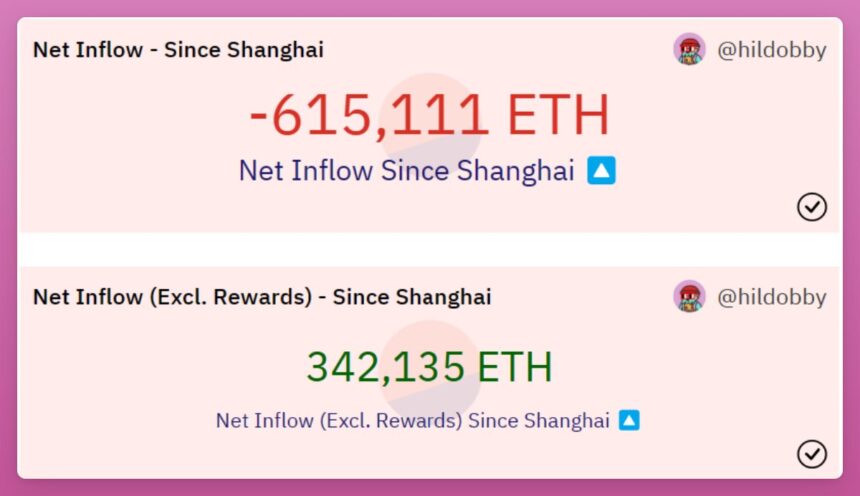

In accordance with DeFi Ignas, latest information means that the staking panorama is shifting, with some main gamers shedding market share and a major quantity of ETH being withdrawn from staking platforms. Specifically, Kraken, Coinbase, and Huobi have all seen a decline of their market share up to now month. Moreover, 36% of all ETH staking withdrawals originate from Kraken.

It’s value noting that when there are extra withdrawals than deposits, it sometimes signifies a bearish sentiment amongst buyers, as they promote their holdings in bigger portions than they’re shopping for. That is additional supported by the truth that round 40% of all ETH stakers have a detrimental ETH PnL, that means they’re holding ETH at a loss.

Nevertheless, there’s a silver lining to this information. In accordance with DeFi Ignas, 29% of all ETH stakers have staked their ETH on the present value, which means that there are nonetheless many buyers who consider within the long-term potential of ETH and are prepared to carry onto their investments regardless of short-term market fluctuations, which for him, this can be a bullish signal for the way forward for Ethereum staking.

ETH Staking, The Greatest Danger/Reward Possibility For Monetary Freedom?

In accordance with DeFi Ignas, Ethereum staking is poised to overhaul decentralized exchanges (DEXes) by whole worth locked (TVL), with simply 15% of all ETH at present staked throughout 83 protocols.

Additionally, regardless of being a comparatively new business, the Liquidity Staking By-product (LSD) ecosystem has already surpassed lending, bridging, and CDP stablecoins when it comes to TVL, and it’s anticipated to proceed rising sooner or later.

Moreover, Distributed Validator Know-how (DVT), which permits “squad staking” by permitting teams to stake totally different quantities of ETH collectively, is one other development gaining traction within the Ethereum staking ecosystem.

On the identical notice, the distinguished crypto analyst McKenna has acknowledged in a latest Twitter post that Ethereum’s staking price has elevated from 14.15% to 14.93% post-Shanghai, and this development is anticipated to proceed. McKenna predicts that ETH staking will grow to be a serious sink, with a staking price shut to twenty% by the top of the yr.

The rise in staking can be a bullish signal for the way forward for Ethereum, because it demonstrates the neighborhood’s dedication to the community and its success. As extra funds are locked in staking, the circulating provide of ETH decreases, making a shortage that might probably drive up the asset’s value.

Featured picture from Unsplash, chart from TradingView.com