- Ethereum has strengthened its recovery course with price action indicating seller exhaustion.

- Bullish speculators are betting on the debut of a US-based spot Ethereum ETF to spur a bullish turnaround.

Ethereum [ETH] was trading in the green on 9th July after an eventful previous day that saw prospective issuers of a US spot Ethereum exchange-traded fund (ETF) submit their amended registration forms.

VanEck, 21Shares, Franklin Templeton, Grayscale, Fidelity and BlackRock, filed their updated form S-1s joining Bitwise, which was the first to submit its updated registration statement last Friday.

US spot Ethereum ETF listing on the horizon

Grayscale submitted two amended filings – one for its Grayscale Ethereum Trust (ETHE) and another for its Mini Trust.

Only Invesco missed the 8th July deadline set by the US Securities and Exchange Commission (SEC) last month when it returned the initial registration forms from the issuers with highlighted areas to fix before refiling.

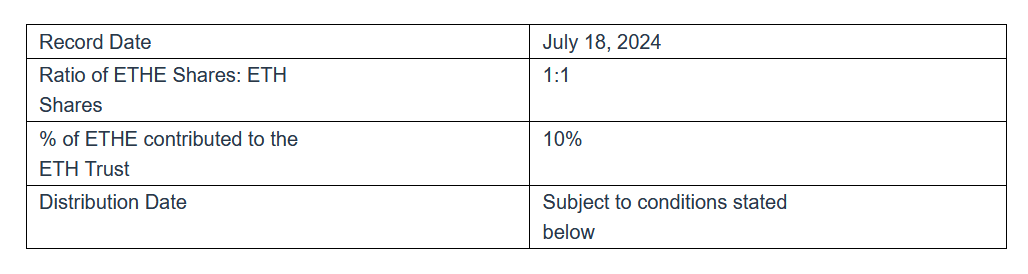

Grayscale shared in a separate announcement to investors that the first issuance and earliest distribution of shares of its new Ethereum Mini Trust (ETH Trust) will be on 18th July.

Source: Grayscale

The asset manager also confirmed in the announcement that it plans to list the ETH Trust on NYSE Arca pending approval.

One more hurdle before it is time

Regarding the next steps, Bloomberg ETF analyst Eric Balchunas said the SEC is expected to review the refiled registration statements and get back to the issuers with a game plan for the final listing.

Balchunas wrote on X,

“[The] SEC asked for the S-1s on July 8th but told issuers the fee wasn’t [necessary] yet. They will give guidance back to issuers soon along with the game plan. Then the docs come will come back with fees (and every other blank) filled and then it’s go time.”

Markets have eagerly anticipated the final greenlight, allowing spot Ethereum ETFs to begin trading.

Balchunas projected that the proposed ETFs may go live on 18th July, although a precise timeline will depend on feedback from the US federal securities regulator.

Balchunas added,

“We don’t have a new over/under launch date yet because we haven’t heard what the SEC’s game plan is […] But if you forced me gun to head style to give my best guess for the date I’d go with July 18th.”

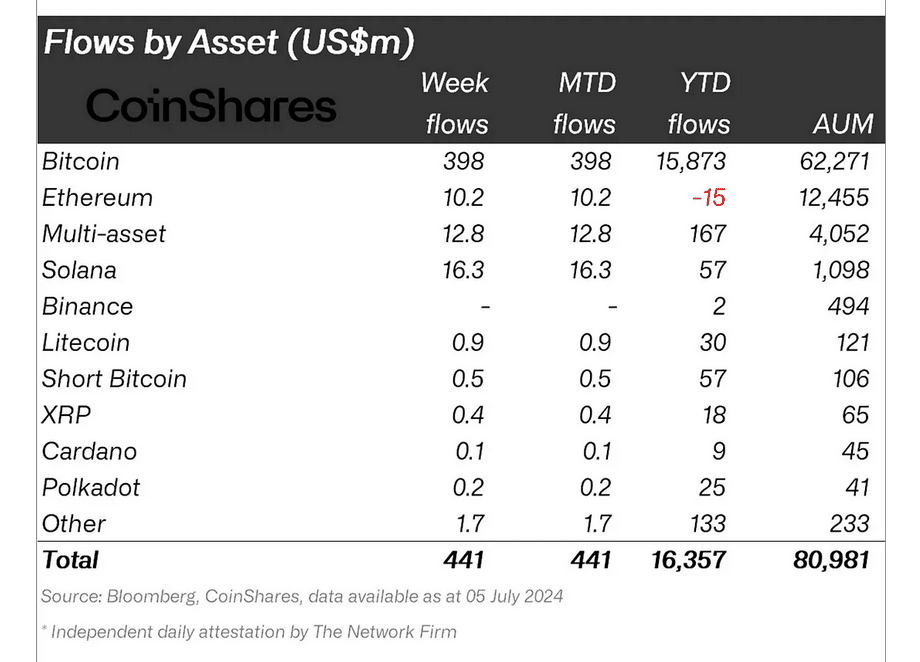

In its digital asset fund flows weekly report published on 8th July, CoinShares noted that Ethereum-based investment products saw inflows totalling $10.2 million last week.

Source: CoinShares

The report also ranked Solana top among the listed assets in terms of weekly crypto asset flows – with $16.3 million inflows compared to Ethereum’s $10.2 million.

Worth noting, VanEck and 21Share are separately seeking approval for their spot Solana ETFs – the VanEck Solana Trust and the 21Shares Core Solana ETF.

The Chicago Board Options Exchange (CBOE) filed two forms 19b-4 with the SEC for the VanEck and 21Share products on 8th July. VanEck and 21Shares earlier filed their SEC form S-1s on 27th June and 28th June, respectively.

ETH/USDT technical analysis

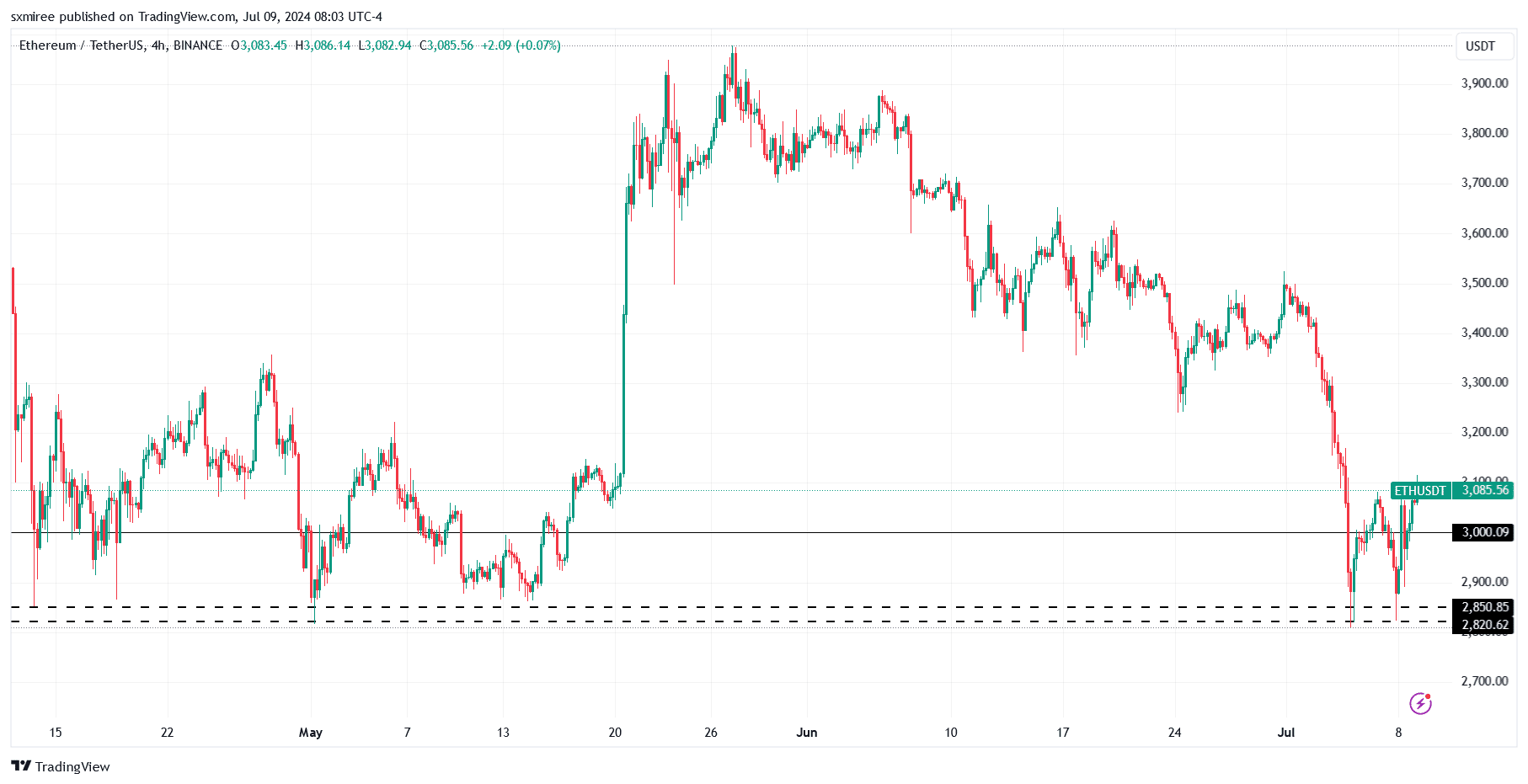

ETH briefly retested the support zone around $2,800 to $2,850 on 8th July before bouncing above the $3,000 psychological level ahead of the daily close.

The recovery extending to press time came on the back of a successful defense of the long-held support zone, which bulls previously defended between April and mid-May.

Source: TradingView

Steadying prices in the last 24 hours back technical indicators and signals hinting at a potential rebound.

Read Ethereum’s [ETH] Price Prediction 2024-2025

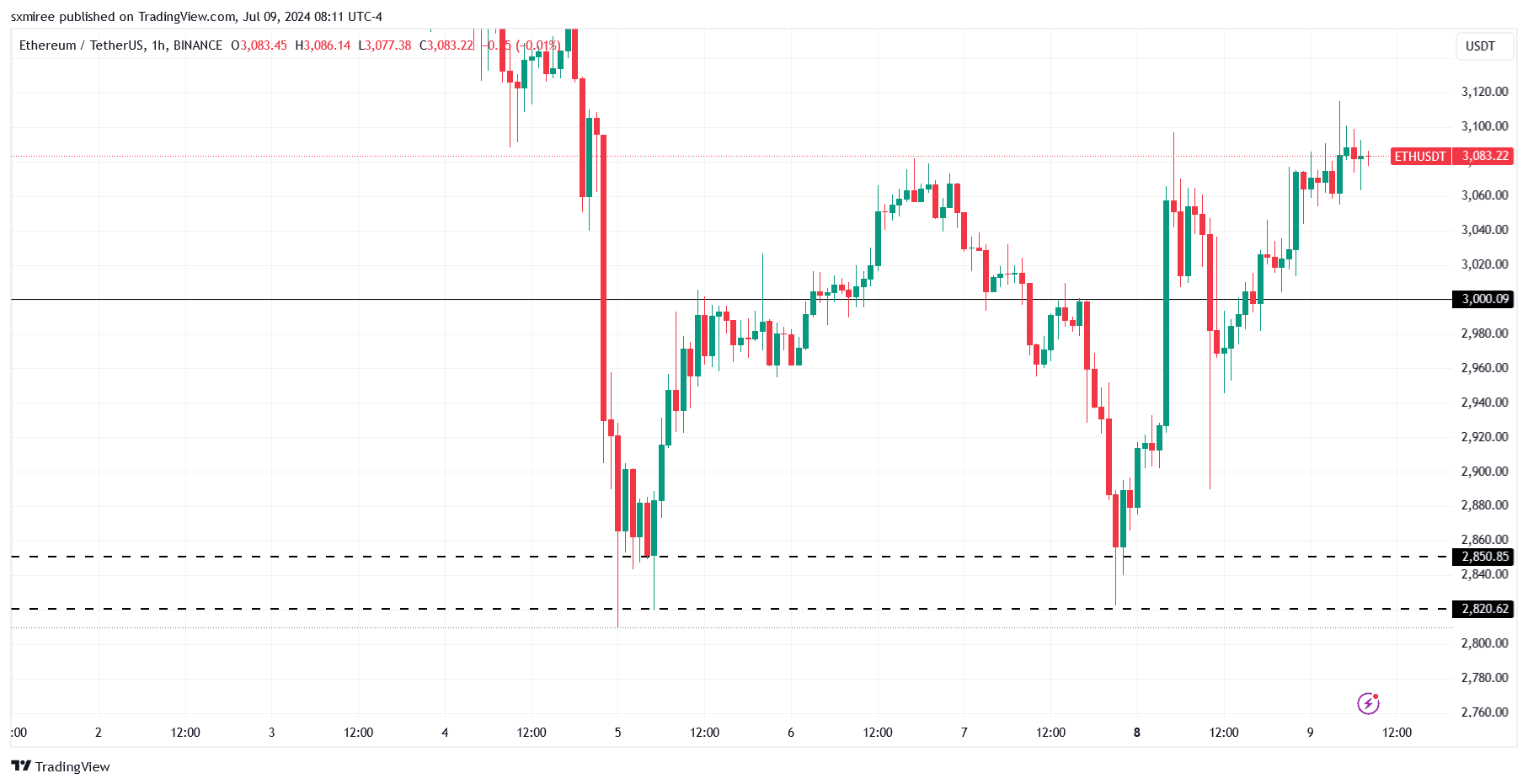

On the hourly chart, the ETH/USDT pair traced a W-shaped double-bottom pattern above the crucial support coming off the weekend, teasing a bullish turnaround.

Source: TradingView

Long-wick candles around the $2,800 – $2,850 critical support further suggest seller exhaustion at the zone and a potential trend reversal to the upside.