- Ethereum is establishing itself as a unique asset, carving out its own identity.

- Several factors are contributing to this development.

Two years ago, the crypto market was rocked by the collapse of FTX, sparking widespread fear and triggering intense regulatory concerns. Fast-forward to today, and the landscape has transformed.

The market is back with a vengeance, and Ethereum [ETH] is leading the way. ETH recently broke out of a four-month slump in under five trading days, posting daily gains close to 10%.

In early bullish cycles, capital often shifts from Bitcoin into altcoins as investors chase new opportunities for profit.

However, with election uncertainty easing – an event that briefly pushed Bitcoin dominance over 60% – Ethereum is now emerging as a distinct asset class, not just another high-cap altcoin.

Could this pave the way for ETH to outperform Bitcoin [BTC], as investors begin to view it with fresh conviction?

Ethereum is on a journey of self-discovery

Trump’s pro-crypto manifesto has clearly resonated with investors, propelling Bitcoin close to $80K.

Trading at $79,500 at press time, Bitcoin has posted a gain of over 15%, and it’s still less than a week since the election results were announced.

However, this rapid growth in such a short time could spark caution among investors, particularly the “weak hands” – those who are quick to exit when Bitcoin enters the risk zone.

This could create a prime opportunity for Ethereum, a potential shift that AMBCrypto suggests it may capitalize on, much like it did during the mid-May cycle.

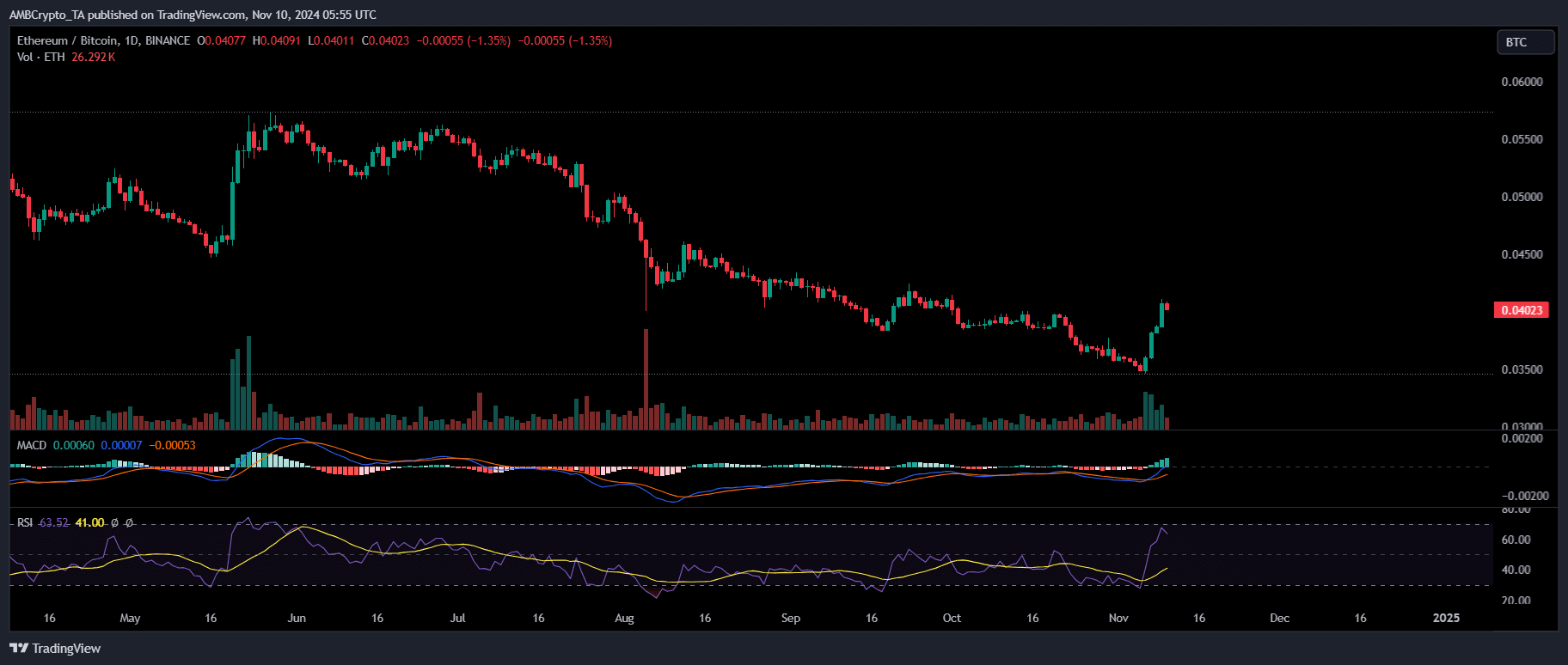

Source : TradingView

After six months of consistent downtrend, Ethereum demonstrated significant dominance over Bitcoin. The last time this happened, ETH posted a massive daily candle, highlighting a 20% surge in a single day.

Similarly, this time, a substantial flow of capital from Bitcoin into Ethereum has played a key role in helping ETH break the $3K benchmark.

However, there’s more to this shift, which could signal Ethereum’s growing independence from Bitcoin, positioning the two as distinct asset types in the market.

There is sufficient evidence to back this notion

To begin with, Ethereum’s weekly gain has doubled in comparison to Bitcoin, reaching a remarkable 30%. Driving this surge are double-digit capital inflows into ETH ETFs.

This is a game-changer, as it marks the first time ETH ETFs have seen a massive influx of capital since their launch four months ago. Initially, despite the launch, the impact on ETH’s price was minimal.

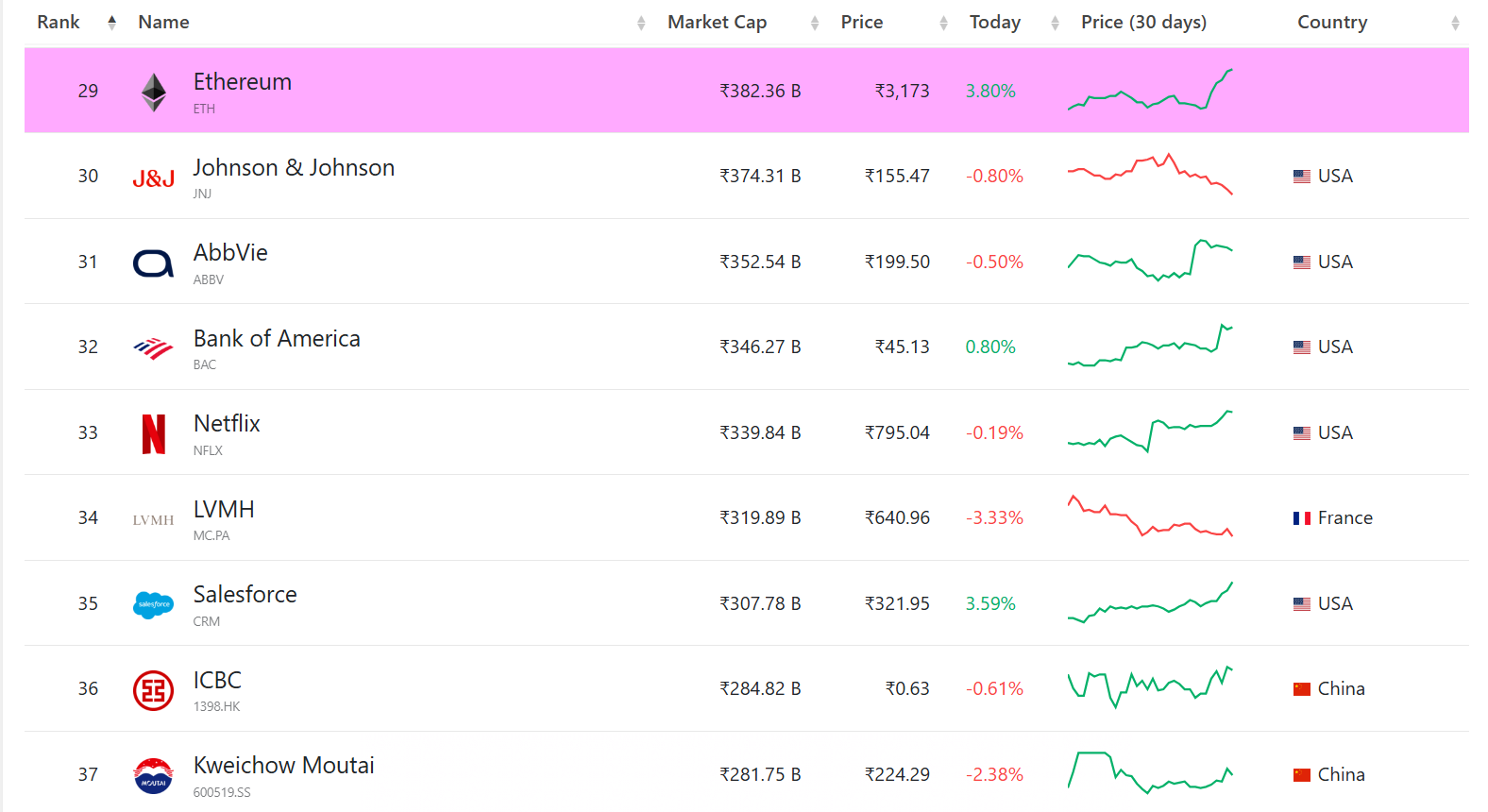

However, this recent surge signals a shift, propelling Ethereum back into the top 30 most valuable assets in the world, with a market cap of $382.36 billion.

Source : CompaniesMarketCap

These developments suggest a growing community of institutions backing Ethereum’s long-term potential. This institutional support is crucial in mitigating any near-term pressure that could push ETH southwards.

Additionally, what was once dubbed the “Ethereum killer,” Solana has lived up to its name. Since the past cycle, Solana has attracted notable liquidity from Bitcoin, trading above $200.

This caused a stir in the market, leading analysts to wonder if a market shift is underway, with Ethereum potentially losing ground to its rival.

While Ethereum still lags behind Solana on various fronts, its 7-day growth in several key metrics has been impressively strong.

With weekly revenue up 250%, compared to Solana’s 67%, and daily transactions increasing by 10%, far outpacing Solana’s 3%, Ethereum is showing resilience.

Is your portfolio green? Check out the ETH’s Profit Calculator

Thus, this bull cycle has been a game-changer for Ethereum. While it may face some sideways pressure at key resistance levels, this surge has definitely boosted its long-term outlook.

Ethereum is now primed for a potential breakout, with a real shot at surpassing the $3.5K mark in the near future.