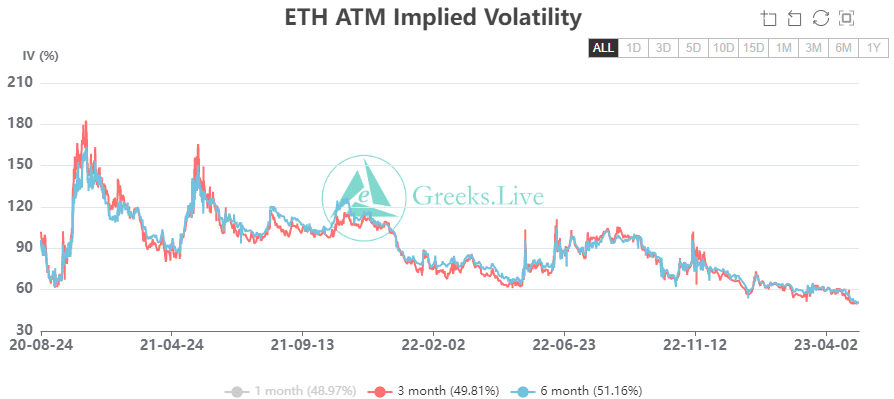

- Implied volatility for Ethereum took a massive plunge.

- Ethereum Foundation sold some of its ETH holdings.

As part of its growth roadmap, the Ethereum protocol is supposed to undergo numerous changes and upgrades. Now, interestingly, every time there is some upgrade on the network, the Implied Volatility (IV) of ETH increases.

Realistic or not, here’s ETH’s market cap in BTC terms

However, over the last few days, Ethereum’s Implied Volatility has declined.

According to data provided by GreeksLive, the long-term implied volatility (IV) for ETH ATM (At-the-Money) options reached a historic low of 50%.

Consequently, the IV levels for ETH now align with those of BTC, inferring that the market has assimilated future volatility expectations for ETH to be on par with BTC.

Source: Greeks Live

For context, Implied Volatility (IV) is a measure of the expected volatility of an asset, derived from the prices of options contracts. A decline in implied volatility for ETH may indicate a decrease in the market’s expectation of future price fluctuations of ETH.

This means that market participants perceive that the probability of large price swings in ETH is lower than before.

Despite the low volatility experienced by Ethereum, the put-to-call ratio for Ethereum continued to increase for Ethereum across exchanges.

An increasing put-to-call ratio for Ethereum may suggest that market participants are becoming more bearish on the future price of ETH, as they are purchasing more put options to hedge their positions or speculate on a potential decline in price.

Source:The Block

Ethereum Foundation and the bears

You wonder what is the reason behind the unprecedented high level of bearish sentiment around ETH. Well, you might as well thank Ethereum Foundations’ recent behavior.

For context, the Ethereum Foundation is a non-profit organization that supports the development and advancement of the Ethereum blockchain and its ecosystem.

At press time, the Ethereum Foundation sold 15,000 ETH. On the last two occasions when the Ethereum Foundation opted to divest its holdings, the market value of ETH decreased.

Source: TradingView

In terms of activity, the Ethereum network took a massive hit. Over the last month, the overall number of NFT trades occurring on the network declined materially. Consequently, there was a decline in gas usage as well.

Is your portfolio green? Check out the Ethereum Profit Calculator

Notably, if the activity on Ethereum continues to decline, it could impact the protocol negatively in the future.

Source: Santiment