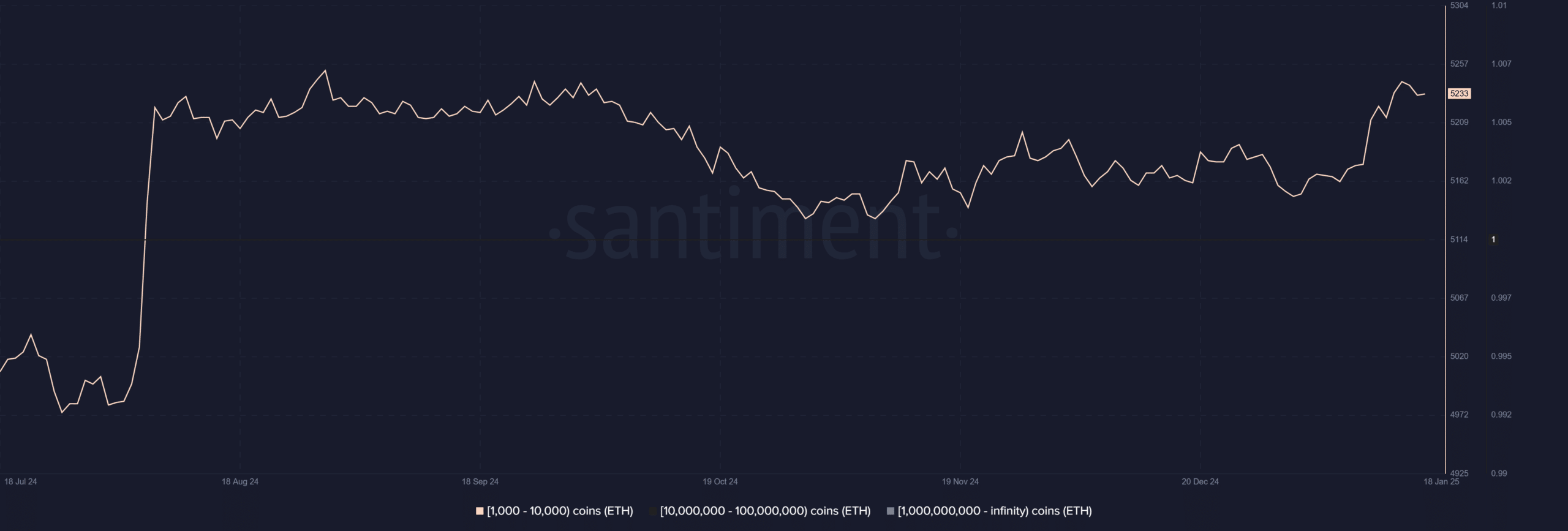

- Whale sentiment hit a 6-month high as addresses holding 1,000-10,000 ETH increased their positions

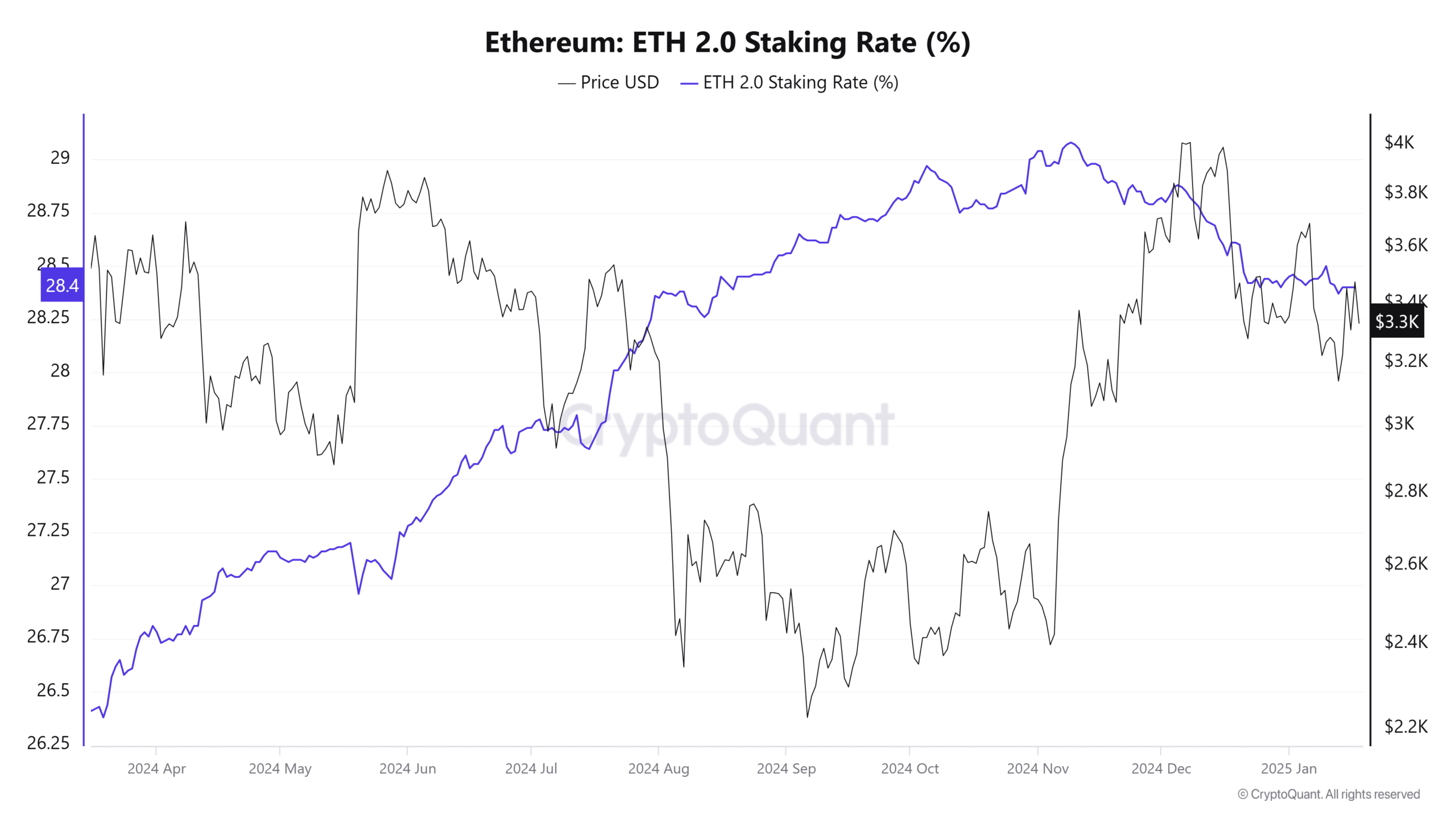

- ETH’s staking rate has climbed steadily from 26.25% to 28.4% since early 2024

In a significant shift reshaping Ethereum’s ownership landscape, whale addresses have expanded their control to approximately 43% of the total ETH supply. This marks a dramatic hike from a 22% share in early 2023, according to IntoTheBlock’s data.

In fact, large holders have accumulated over 330,000 ETH (Valued at more than $1 billion) in the past week alone, with many now leveraging staking opportunities to strengthen their positions.

A dive into Ethereum’s whale behavior

When examining the Santiment index for addresses holding between 1,000-10,000 ETH, the concentration pattern becomes more pronounced.

The analysis showed it has reached its highest levels since August 2024. On-chain data also revealed that these addresses have maintained consistently high sentiment, despite market volatility – A sign of strong conviction in their accumulation strategy.

Source: Santiment

The latest surge in whale addresses coincided with Ethereum’s price stability above $3,000, indicating strategic positioning ahead of potential market movements.

This uptick in confidence also corresponded with institutional staking participation – A sign of a strategic approach to accumulation.

Ethereum staking landscape amplifies concentration

Ethereum‘s staking rate has shown remarkable resilience, climbing from 26.25% in early 2024 to holding steady at 28.4% at press time.

This upward trajectory has persisted, despite significant price fluctuations between $2,200 and $3,800, demonstrating long-term holder conviction. At the time of writing, over 34 million ETH were staked.

Source: CryptoQuant

Supporting this whale accumulation trend, staking data from Dune Analytics revealed a highly concentrated ecosystem.

Coinbase leads centralized exchange staking with 3.27 million ETH (39.24% market share), followed by Binance with 2.14 million ETH (25.73%) and Kraken with 886,625 ETH (10.61%). What this concentration means is that just three exchanges control over 75% of all exchange-staked ETH.

The liquid staking sector is even more striking, where Lido has emerged as the dominant force with 9.59 million ETH staked – Commanding an overwhelming 89.49% market share.

Market implications

The convergence of whale accumulation and staking concentration raises important questions about market dynamics. With over $1 billion worth of ETH accumulated in a week and major institutions controlling significant staked positions, the market has shown signs of greater institutional entrenchment.

While institutional involvement brings stability and legitimacy, the growing concentration of power raises concerns about market manipulation risks and network decentralization. The recent $1 billion accumulation by whales and their significant staking presence could affect market liquidity and price discovery mechanisms too.

– Realistic or not, here’s ETH market cap in BTC’s terms

Finally, aggressive whale accumulation and concentrated staking positions hinted at a maturing market structure. By extension, it showed that institutional players have been establishing long-term strategic positions.