- FTX has announced a plan to repay creditors up to $16.3 billion

- Analysts believe repayments could balance market dynamics, leading to a bullish 2nd half in 2024

FTX, the crypto-exchange that filed for bankruptcy last year, has announced a significant plan to repay its creditors, potentially injecting new momentum into the crypto-market. On 8 May, it was disclosed that the exchange could repay approximately 98% of its creditors, which could amount to as much as $16.3 billion.

Those holding claim amounts below $50,000 are eligible for up to 118% recovery, based on November 2022’s cryptocurrency prices. This move has been welcomed by the market, with CEO Ray noting,

“We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors.”

The repayment plan by FTX is expected to have significant ripple effects across the crypto-market. This was the subject of K33 Research’s latest report, authored by analysts Vetle Lunde and Anders Hesleth.

According to the same, the cash payouts from FTX are likely to create a “bullish overhang” for the market, potentially leading to increased buying pressure.

Analysts weigh In: FTX repayments vs. market dynamics

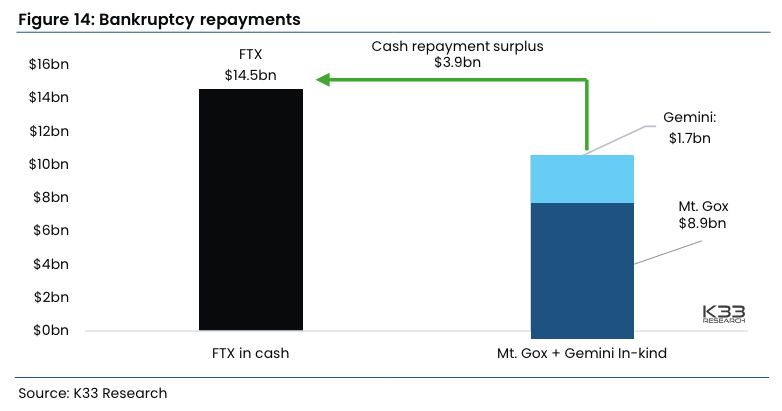

K33 Research’s analysts believe that not all creditor repayments have a bearish impact. In their view, cash-based repayments by FTX will be contrary to the crypto-based repayments planned by other entities like Mt. Gox and Gemini, which are valued at a combined $10.6 billion.

They argue that the buying pressure from cash recipients of FTX could neutralize the selling pressure from those receiving crypto payouts. “Not all creditor repayments are bearish,” they emphasized, suggesting that the overall effect could be more balanced than initially anticipated.

However, the exact influence of these repayments on the market is challenging to predict in advance. Ergo, the timing of these payments will be crucial in assessing their full impact.

While Gemini’s $1.7 billion repayment is expected in early June and Mt. Gox’s $8.9 billion by October 2024, the FTX repayment schedule is still under court review, with most creditors anticipating disbursements later this year.

“The different timing of these repayments represents yet another indication of a slow summer in the market and a solid end to the year.”

Market trends and future outlook

Meanwhile, the global crypto-market has shown strong bullish signs recently, with Bitcoin and Ethereum breaking major resistance levels. Over the last 24 hours alone, the market has surged by 5.8%, adding over $100 billion to the global crypto-market cap.

This uptick has led to significant short trader liquidations. In the aforementioned period, 58,875 traders were liquidated, totaling $159.13 million in liquidations. This wave of liquidations follows a recent trend where ETH and PEPE contributed to $50 million in short trader losses.

Source: Coinglass

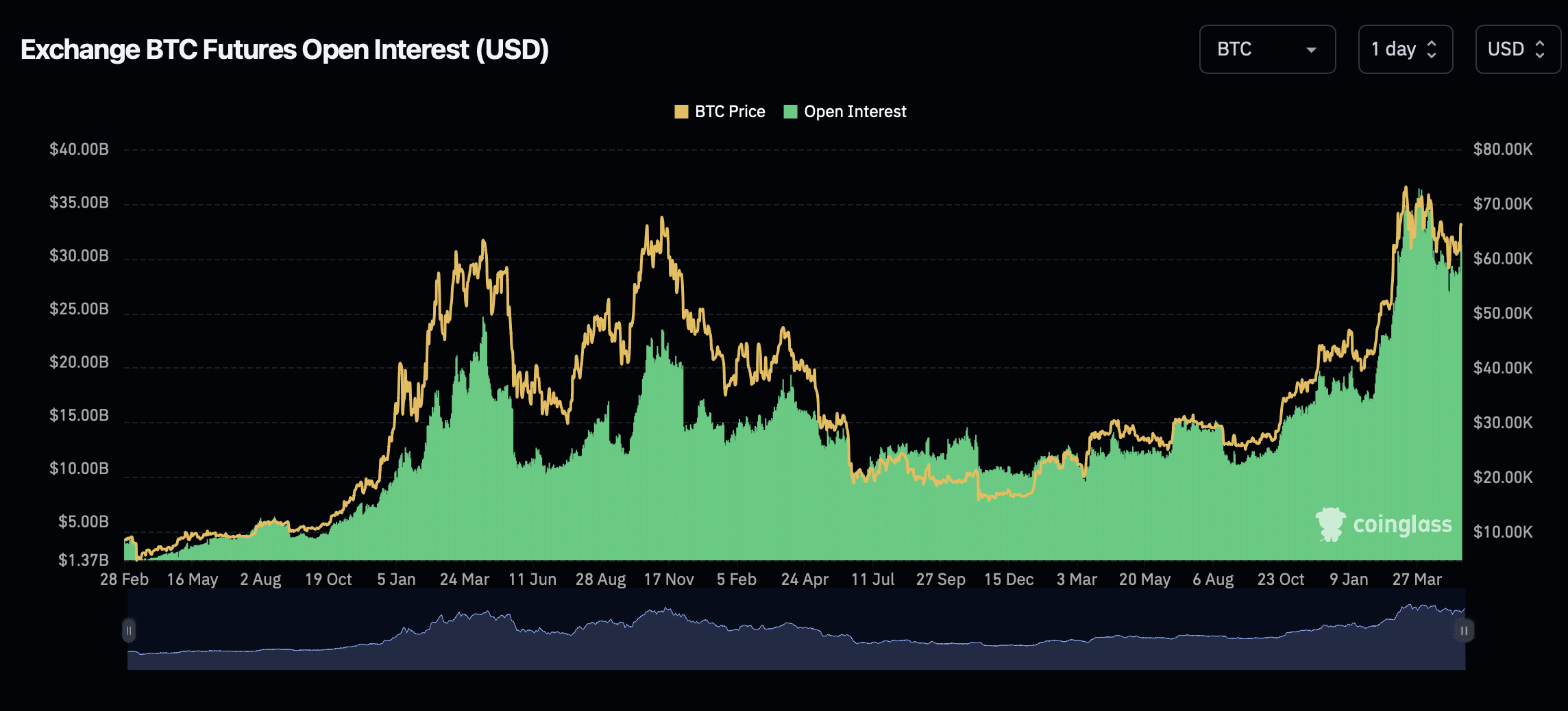

Moreover, the hike in Bitcoin’s open interest, up nearly 10% in the last 24 hours, indicates rising capital inflow into the market. This is also a sign of investors being increasingly confident about the market’s direction.

Source: Coinglass