- Israel versus Iran faceoff takes a fresh turn after Iran launched dozens of drones in an act of retaliation

- The possible situation of a war breakout has resulted in the entire crypto-market taking a huge plunge

The Middle East plunged into a chaotic environment after Iran officially launched an attack against Israel in the late hours of the local time. This has resulted in countries around the world keeping their guard up as the worsening situation could result in significant disruptions. And, the effect of a possible war has had a huge spillover in the crypto-market.

The background that caused the Bitcoin crash

The tension between both countries worsened after Israel’s IDF attacked Iran’s consulate in Syria’s capital – Damascus. The attack resulted in the death of a top Iranian general – Brig. Gen. Mohammad Reza Zahedi and five other members of the Islamic Revolutionary Guard Corps (IRGC).

In response, the Iranian regime proclaimed that there would be a “punishment” for the attack. The regime also warned the United States of an attack if it gets involved in its fight with Israel.

In line with this, the Iranian government launched its attack against Israel. The country has deployed dozens of drones that are set to reach Israel within hours. However, so far, the actual target of the attack remains unclear. Drone activity has been spotted over Iraq, and while it was initially reported that there were about 50 drones, it is now speculated that over 500 drones were spotted.

Moreover, the attack came as a surprise as no one expected the Iranian regime to launch an attack directly from its soil. This is a move made for the first time in its history.

Bitcoin and crypto-markets recovery in line?

Bitcoin and the rest of the crypto market took the plunge immediately after reports of Iran’s attack first emerged. Bitcoin (BTC)’s price plunged to a low of $61,308 but quickly rebounded to trade just above this level, as per TradingView. According to CoinMarketCap, at press time, Bitcoin was trading at $62,388 and its past-day loss stood at over 7 percent.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Notably, the wider crypto market was much worse than the coin, with several cryptocurrencies recording a downtrend of over 15 percent in the past day. Among the top 20 cryptocurrencies, Polygon (MATIC), Shiba Inu (SHIB), Avalanche (AVAX), and Dogecoin (DOGE) saw the biggest hit. The coin had registered a loss of over 18 percent and above in the past day.

For now, the market seems to have stabilized as there has not been a major upward or downward trend in the past hour. However, the possibility of a price recovery seems uncertain at the moment as tensions continue to escalate between both countries.

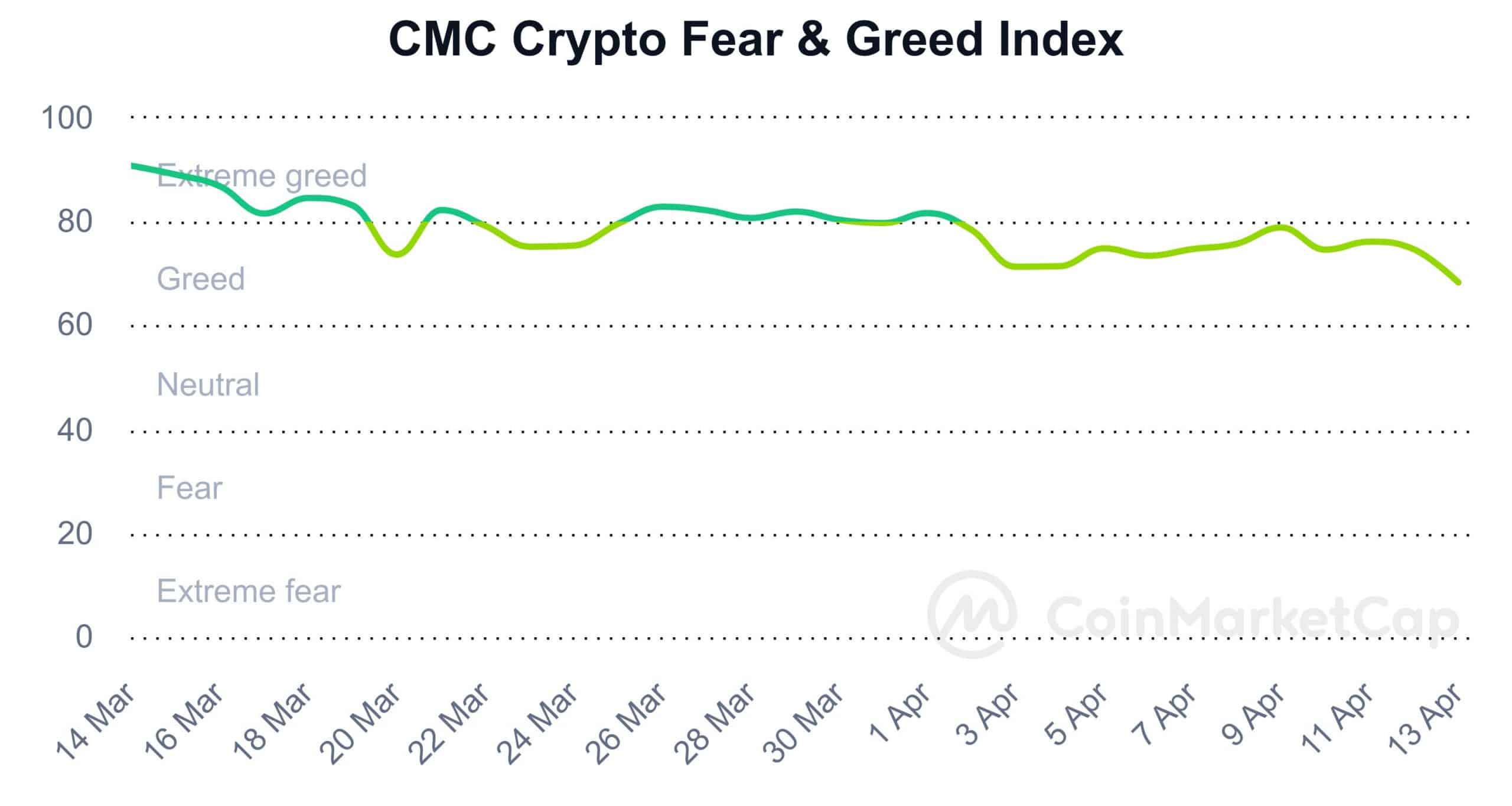

Moreover, while the greed for crypto is high, it has seen a decrease today, hitting its lowest point in the past month. Meanwhile, the Bitcoin options volatility saw a sharp rise today, according to CMC. The volatility index shot up from around 69 to nearly 78.9.

Source: CMC

While the price has dipped, several crypto netizens have expressed that a rebound is bound to happen and could see higher gains. Tony Gallippi – the co-founder of BitPay, said on X,

Once people realize that WW3 is not happening (which it won’t) the capital flows into bitcoin and crypto will be epic. https://t.co/RkCqTaBm5h

— Tony Gallippi (@TonyGallippi) April 13, 2024

Other crypto influencers and founders also expressed their optimism in the end outcome of the events. Particularly so because of the upcoming Bitcoin halving, poised to take place in the next few days. And, based on previous trends, Bitcoin and the rest of the crypto market have registered a massive bull run.

Some of you weren’t hear for the COVID crash and it shows.

Crypto bull market is inevitable provided Boden doesn’t execute a 6102.

R-E-L-A-X pic.twitter.com/wFcyvNi4jj

— Ryan Selkis (d/acc) 🇺🇸 (@twobitidiot) April 13, 2024