Mert Mumtaz, CEO of Helius Labs, a prominent player in the SOL ecosystem, recently shared his thoughts on the ongoing comparison between Ethereum and Solana, two leading Layer 1 (L1) blockchains. Through a series of posts on X (formerly Twitter), Mumtaz outlined several performance aspects where Solana has shown superiority.

Solana Vs. Ethereum

Mumtaz starts out by explaining; “Spot the asymmetry: Solana has exceeded 700 user TPS regularly in the past week — Ethereum does 12 TPS. That’s a 60x difference.” He further emphasized the significant disparity in transaction finality speeds, with SOL achieving approximately 400 milliseconds compared to Ethereum’s roughly 15 minutes. This represents a 2,250x difference.

Moreover, he pointed out the stark contrast in average transaction fees, where Solana averages $0.00025, substantially lower than Ethereum’s range of $1.5 to $20. Regarding network size, Mumtaz mentioned, “Solana has ~3k nodes — Ethereum has around 8k nodes. That’s a 2.6x difference.”

Mumtaz acknowledged Ethereum’s higher level of decentralization but questioned the practical impact of this difference beyond a certain threshold. He also remarked on the importance of balancing decentralization with performance and accessibility, suggesting that extreme skewing towards one aspect might not be ideal.

“This is not a dunk on Eth […] Both Ethereum and Solana are decentralized. Ethereum is more decentralized, yes, but how much of a difference does that make past a certain threshold? At the end of the day, you need to be able to build cheap, fast, scalable apps,” Mumtaz elaborated.

Mumtaz also speculated on the future of crypto activity, suggesting that even in an optimistic scenario, a combination of SOL with L2s might be the ideal solution: “So if you assume an overly optimistic future for crypto activity such that it pushes beyond the limits of a single L1 with Moore’s law or all L2s combined, then the ideal solution would still approximate something like Solana + L2s.”

Joe McCann, CEO and CIO of Asymmetric, further contributed to the discussion by highlighting data from Galaxy Digital that emphasizes Solana’s growing prominence in the decentralized finance (DeFi) sector. McCann pointed out, “The number of Solana DeFi users interacting with 10+ smart contracts (programs) daily is at a year-to-date high, representing 1.15% of all active DeFi addresses.”

This statistic places SOL significantly ahead of Ethereum and other Layer 1 solutions in terms of daily active DeFi interactions. He noted that this represents an 11.5x increase over Ethereum and even greater multiples over other competitors: 6.88x more than Optimism, 16.4x more than Arbitrium and Avalanche, and more than 23x more than Polygon.

Cathie Wood Acknowledges SOL

In a recent interview with CNBC Squawk Box, prominent investor Cathie Wood discussed the evolving landscape of blockchain infrastructure. While acknowledging Ethereum’s status as the leading smart contract and decentralized finance network, Wood also recognized SOL’s growing significance.

Related Reading: FTX Bankruptcy Is Now One-Year Old – How Has Solana (SOL) Fared Since Then?

Wood explained, “Solana is doing a really good job. I mean, if you look at Ether, it was faster and cheaper than Bitcoin back in the day. That is how we got Ether. Solana is even faster and cost-effective than Ether.”

She emphasized the importance of infrastructure plays in the blockchain space, hinting at SOL’s potential role in the development of Web3 and digital assets, including the implementation of online property rights.

Her comments reflect a broader industry perspective that, while Ethereum currently holds a dominant position, Solana is gaining traction due to their enhanced performance characteristics and cost efficiency.

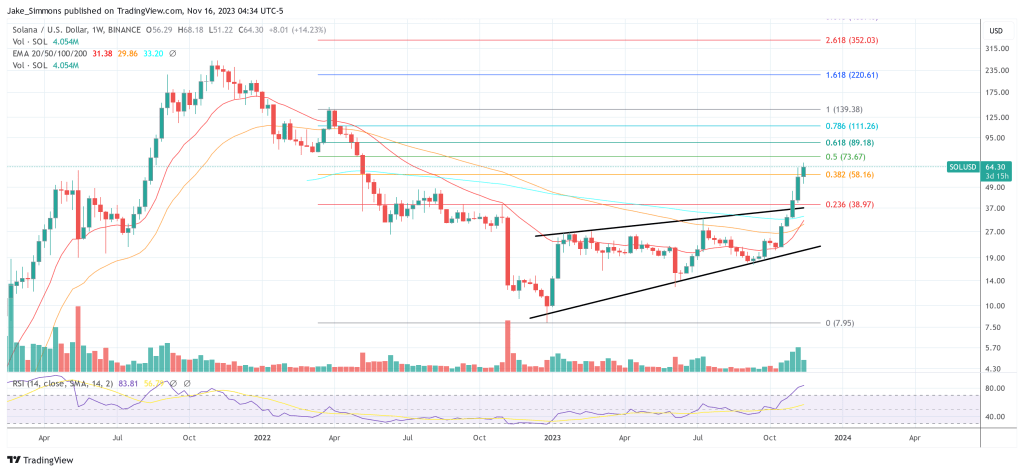

At press time, SOL traded at $64.30.

Featured image from WoolyPooly, chart from TradingView.com