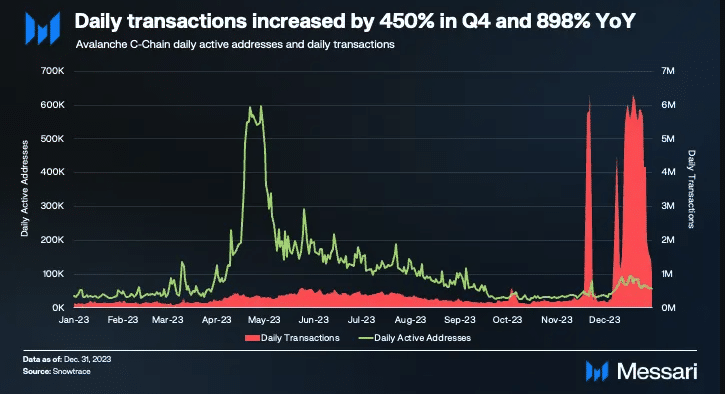

- Interest in Avascriptions drove an increase in transactions.

- Active addresses and stablecoin supply on the blockchain decreased.

Rising 11 places from 20th to 9th in terms of market cap was only one of Avalanche’s [AVAX] landmarks in Q4 2023. During the same period, the blockchain registered growth in other aspects. However, that doesn’t mean there were no pitfalls.

According to AMBCrypto’s evaluation of the Q4 report put together by blockchain research firm Messari, it was found that daily transactions on Avalanche increased by 450%. The report noted that the introduction of Avascriptions was responsible for the increase.

Avascriptions are inscriptions on the Avalanche C-Chain.

Inscriptions lead the way but it’s not enough

From the report, the inscriptions which were an imitation of Bitcoin Ordinals emerged in November. By the 20th of December, the blockchain recorded a daily revenue of $10.6 million. This was mainly because of the demand for AVAX as interest in Avascription climbed. The report read,

“C-Chain hit an all-time high of 6.3 million transactions on November 22, surpassing the previous all-time high of 1.1 million on January 27, 2022. Of these 6.3 million transactions, nearly 6.1 million were inscriptions.”

However, an increase in transactions did not automatically turn into a jump in active addresses. Based on the assessment, active addresses on the chain dropped from 89,400 to 44,400. This represented a 50% decline. Regardless, the research firm was able to identify the cause.

According to Messari, Avalanche’s decrease in user activity was linked to the rising attention LayerZero got. Like Avalanche, LayerZero also uses a sidechain structure. However, the latter focuses on cross-chain communication between 50+ blockchains.

The fundamentals of the project were not the major reason Avalanche lost users to it. Instead, it was the perception that LayerZero would announce a airdrop and launch a native token soon. Therefore, users flocked to the network so they could be a part of the eligible addresses.

Security improves, stables look the other way

Meanwhile, active validators on Avalanche increased by 20% during the quarter. When Q4 began, the number of active validators was 1,374. But by the end of the year, that number had increased to 1,651. As a result of the increase, the Nakamoto coefficient improved.

The Nakamoto coefficient is the number of node operators controlling a large part of the network. Therefore, the increase meant that Avalanche was increasingly resistant to attacks.

However, stablecoin supply on the chain fell. BTC.b, which is the token that represents Bitcoin also experienced a drop in usage. The report noted,

“Despite a surge in Q2, the supply of BTC.b finished down 12% YoY in 2023, from 4,271 to 3,777 BTC.b. This decrease may be due in part to the emergence of ordinals and the wider Bitcoin ecosystem in 2023. Stablecoins on Avalanche also ended 2023 down 30% YoY from $1.56 billion to $1.09 billion.”

How much are 1,10,100 AVAXs worth today?

Going forward, it seems the blockchain has more to achieve. If things work out as planned, Avalanche could become a giant in the gaming and Real World Assets (RWA) sector of the ecosystem.

The reason for this projection could be connected to its links with some traditional institutions and its strides with NFTs.