- Ethereum’s MVRV momentum neared a bullish cross, with technical indicators signaling strong upward potential

- Higher derivatives activity and short liquidations lent fuel to Ethereum’s bullish momentum

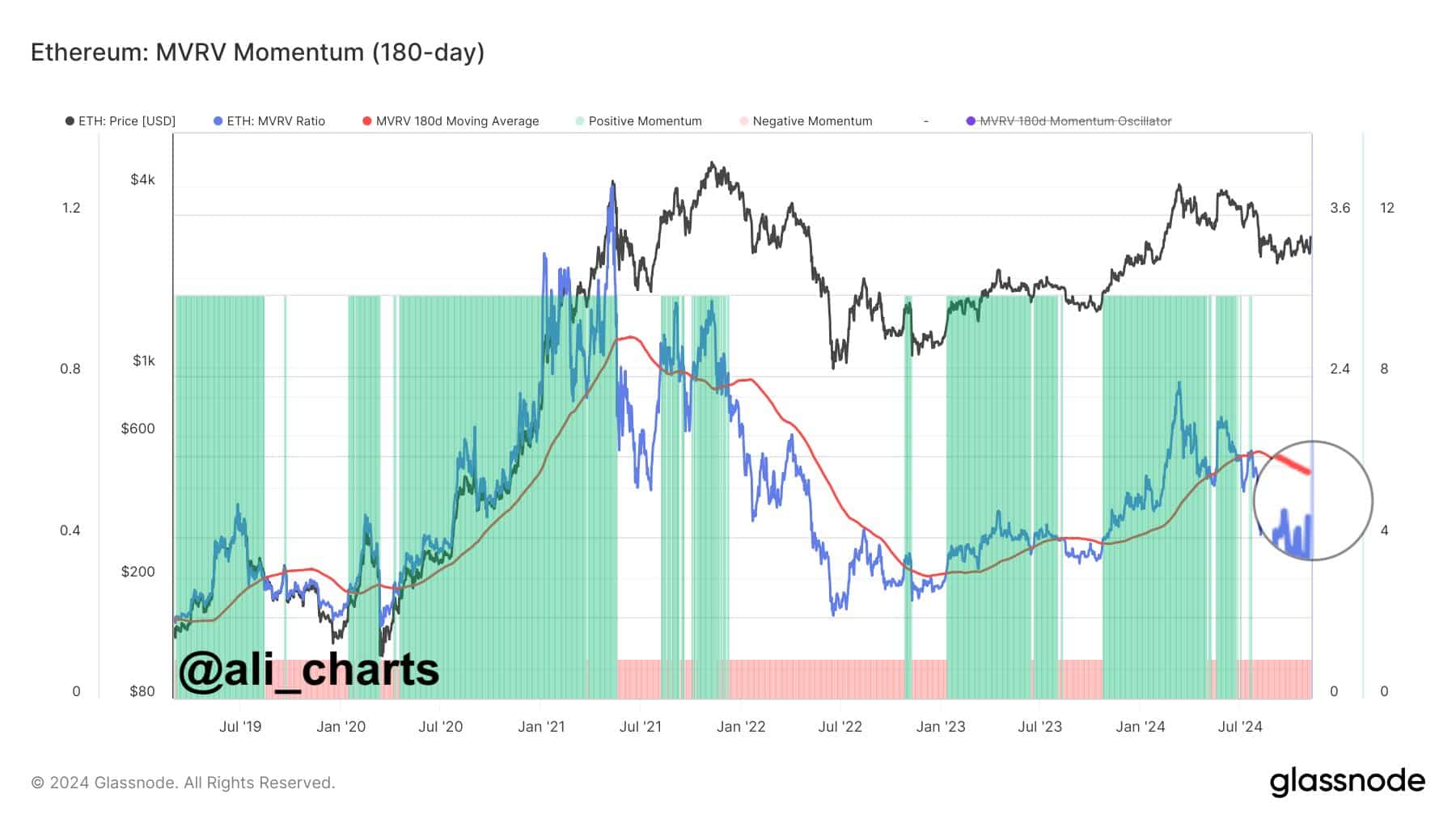

Ethereum [ETH], at the time of writing, was gaining traction as it seemed to be approaching a critical MVRV Momentum cross above the 180-day moving average—A historical indicator of bullish performance. This signal, closely watched by traders, often marks the start of Ethereum’s strongest uptrends by highlighting when ETH is undervalued, relative to the average profit margin of its holders.

Following ETH’s recent rally from $2,400 to $2,800, the crypto community is eyeing this cross as a potential catalyst for further gains.

At press time, ETH was trading at $2,829.58, following a 7.19% hike in the last 24 hours. However, as this cross is yet to occur, there may still be more room for Ethereum’s momentum to build. Hence, the question – Does this mean a major rally may be on the horizon?

Source: X/Ali

ETH chart analysis – Technical indicators signal strength

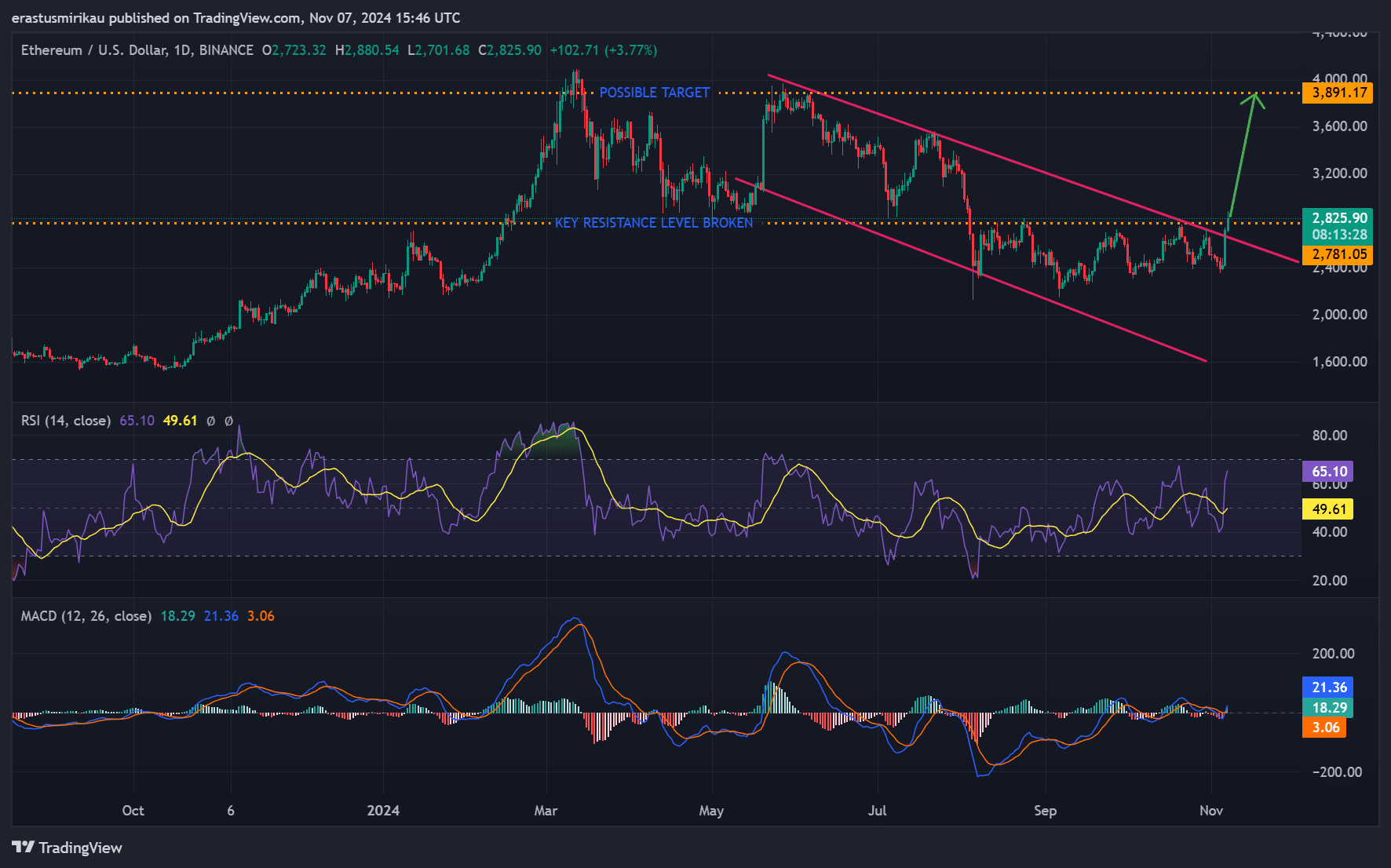

Examining Ethereum’s daily chart, key technical indicators revealed a promising outlook. ETH recently broke above a descending channel, indicating a shift in momentum. At press time, the RSI had a value of 65.10, slightly below the overbought threshold. This suggested that there’s still room for further upward movement.

Meanwhile, the MACD crossed above the signal line, confirming a bullish trend that could support further gains if buying pressure continues. This confluence of indicators highlighted ETH’s strong position as it neared a critical resistance, setting the stage for a possible run towards its next target of $3,891.

Source: TradingView

ETH derivatives data – Rising investor interest

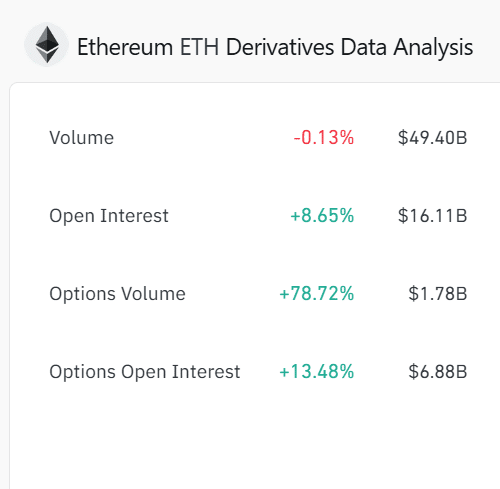

Ethereum’s derivatives data reinforced this positive outlook. Open interest climbed by 8.65% to $16.11 billion, showing greater trader engagement. Additionally, Options Open Interest grew by 13.48% – Totaling $6.88 billion – While Options volume surged by 78.72%.

This hike in activity alluded to confidence in Ethereum’s near-term growth potential. Especially as more investors position themselves for potential gains.

Source: Coinglass

Ethereum liquidation levels – Shorts face pressure

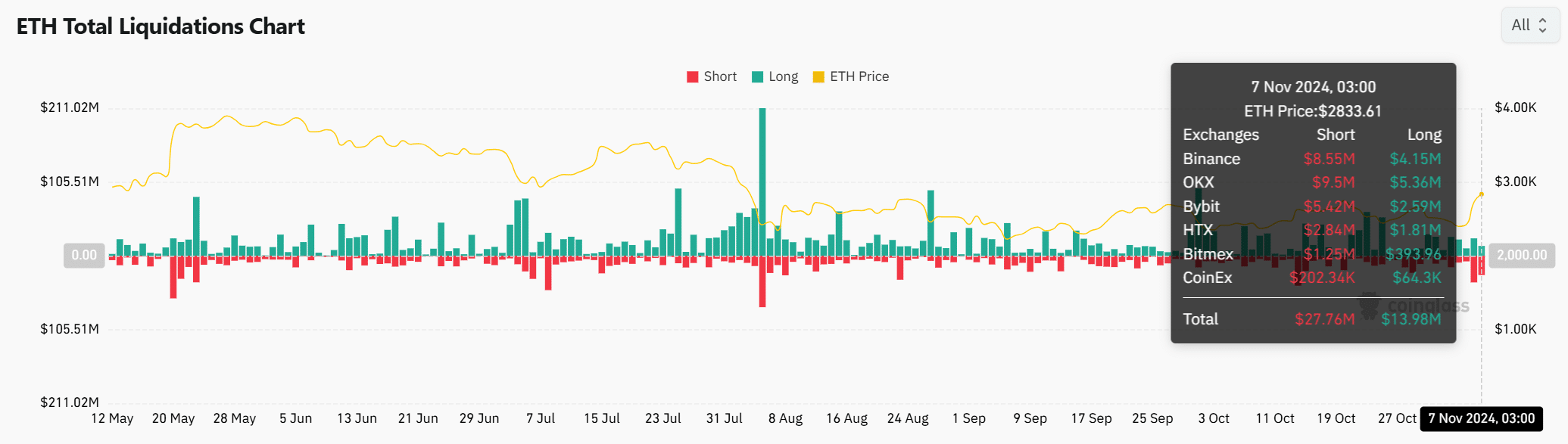

Liquidation data further underscored ETH’s current dynamics. On 7 November, total liquidations hit $41.74 million, with shorts comprising $27.76 million. This wave of short liquidations highlighted mounting pressure on bearish positions, which could drive further buy-side support.

If Ethereum’s price continues to climb, additional short liquidations could follow, amplifying bullish momentum.

Source: Coinglass

Read Ethereum’s [ETH] Price Prediction 2024–2025

Will Ethereum’s MVRV momentum cross confirm a rally?

With Ethereum nearing a crucial MVRV Momentum cross, strong technical indicators, greater derivatives activity, and short liquidations all pointed to a potential rally. However, caution may be warranted until the cross occurs.

If confirmed, this signal could push Ethereum toward its $3,891 target. Will ETH continue north and meet bullish expectations, or will resistance hold it back? Ethereum’s next moves are crucial and will be closely watched.