Have you heard the term “bear market” or the “market looks bearish”? The terms bull and bear markets often enter into most investment-related conversations today. A bear market is characterized by a prolonged period of time where asset prices fall by 20% or more from their closest high, and speculations on market movement are primarily negative.

What causes a bear market in cryptocurrency?

The crypto market, like other investment markets, is cyclic in nature. It goes through four stages – Accumulation, the bull run, distribution, and the bear run. This cyclic nature lets investors who missed being involved in an earlier market cycle invest in cryptocurrencies of their choice. It helps the market stay healthy and functional.

Since cryptocurrencies are speculative, they are subject to being influenced by factors like changing market cycles, regulatory uncertainty, market manipulation, technological challenges, macro and microeconomic challenges, etc. Any of these factors or a combination of them may trigger a bear run.

Bear markets help the market correct itself and begin a new market cycle. It also allows investors time to plan their strategy better for the next bull run, as proven by previous bear runs.

Historic bear markets

Image credits: CoinMetrics

The graph illustrates two historic crypto bear runs preceding the current one.

- 2011: Crypto’s First Bear Market, following the hack of Mt. Gox, an exchange based out of Japan.

- 2013: Crypto’s Second Bear Market was triggered when the Silk Road, an online black market, was taken down by the FBI, and the crash of Mt Gox in 2014.

- 2018: The Great ICO Crash was triggered when the market could not sustain the continued ICOs and Ponzi Schemes affecting investors. Despite this, the market recovered, and Bitcoin hit its all-time peak of $68,789 in the 2021 bull run.

If you’re wondering how to identify if we are in a bear market, look no further.

Signs of a crypto bear market

Here are some indicators of a bear market that you can identify to ascertain if the market is going through a bearish phase.

- The prices of assets fall by at least 20% from a high for a prolonged period of time.

- Many investors are discouraged and in a rush to save their capital

- Investor confidence hits rock bottom, and there is significant FUD ( Fear, uncertainty, and doubt) in the market

Investing in crypto during a bear market does not have to be tough. Here are some tested and time-proven strategies to help you make the most of your investment.

How can you invest in cryptocurrency during a bear market?

Here are some crypto bear market strategies to invest in crypto:

- Dollar-Cost Averaging

- Buying the dip

- Diversifying your portfolio

- Staking

- Yield farming

- Investing in large-cap cryptocurrencies

- Long-term HODLing

- Short-term trading

Dollar-Cost Averaging

With the dollar-cost averaging (DCA) strategy, you invest a fixed amount in your chosen cryptocurrencies or a crypto index at regular intervals, irrespective of market conditions. By doing this, you reduce your average investment cost over time.

Let’s say there’s a cryptocurrency called X whose price changes every week depending on several factors. Sometimes it costs 8 dollars and at other times, you can buy X for as low as 2 dollars. Dollar-cost averaging is like buying X each week with the same amount of money, say 4 dollars.

Instead of getting a large amount of X at once, you buy a little bit each week. This way, sometimes you get more of it when its price is low, and sometimes less when the price is high. For example, if X costs 1 dollar in a certain week, you can buy four of it that week. If it costs 4 dollars, then you’ll only be able to get one of it.

DCA It helps you average out the cost over time and not worry too much about the candy’s price each time you buy. Same idea with investing money regularly in stocks or cryptocurrencies.

Bearish markets are uncertain periods where price movements of crypto assets cannot be predicted. A sound strategy like DCA can help spread your investments by investing small sums of money over time instead of a large lump sum investment at once.

Buy the dip

This strategy is a favorite amongst crypto HODLers. Investors with capital available on hand often buy large amounts of cryptocurrency during bearish trends in the market. By “Buying the dip,” the investors affirm their belief in a coin’s ability to bounce back and believe that they will earn a neat profit as the market turns bullish.

Investors have two options when dealing with price dips in the cryptocurrency market. They can either buy when prices drop significantly all at once, or they can implement a Dollar-Cost Averaging (DCA) strategy.

Don’t time the market

Investors who have the ability to analyze price movements and conduct technical analysis of coins can use indicators to gauge if a coin has reached its lowest price point before bouncing back. However, it is impossible to predict the dips in the market accurately. The best way to accurately buy the dip is by using the DCA investment strategy and stand to get better results when buying the dip.

Diversify your portfolio

Diversification is a great way to reduce the risk on your investment as it splits the risk. Instead of investing all your money in one cryptocurrency, you invest it in smaller amounts across various cryptocurrencies to reduce the associated risk.

Imagine this: you are impressed by Ethereum’s growth and invest all your money in it. However, the market turns bearish, and you now face a risk of suffering serious losses.

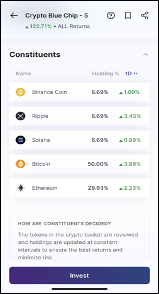

However, if you had invested in a crypto basket like Crypto Blue Chip, i.e., across Bitcoin, Ethereum, XRP, BNB, and Solana (the top 5 cryptocurrencies by market cap), your investment and the risk would be split across these assets. These crypto baskets are curated by experts and are balanced monthly to give you the best risk-reward ratio. This could prove crucial during a bear market.

While diversifying or investing in general, remember not to invest money you cannot afford to lose. Now, you may be wondering how to identify promising coins you want to invest in.

Identify the coins you want to invest in

To identify the cryptocurrencies to invest and diversify in, you will need to look at:

- The asset’s all-time high and study its past price performance.

- You should be paying special attention to how it performed during past bear cycles to identify potential future behavior.

- You should also see how it correlates with Bitcoin and the rest of the crypto market, if it outperforms, underperforms, or follows the market trend.

- You should also look for future developments in the coin’s roadmap since they could potentially lead to price movement.

Additionally, you should study market trends and keep updated on how other investors feel about the coins you have invested in. Knowing the community engagement and sentiment towards a particular coin could help you predict future price movement and any actions you may have to take.

Staking

During bearish times, you can consider staking or locking up your crypto on a network to earn rewards and become a validator, With staking, you earn passive rewards that could help cover losses due to bearish trends. It would also help you prevent panic selling as your crypto is locked up.

Yield farming

You can choose to deposit your crypto onto DeFi platforms and contribute to their liquidity. This way, you earn rewards from the platform’s earnings as you contribute to its liquidity. You may even stand a chance to earn more tokens and generate free tokens or a passive income to help cover potential losses.

Consider investing in Large-cap cryptocurrencies

During a bear market, large-cap cryptocurrencies could be a safe bet. For example, you could consider investing in Bitcoin and Ethereum, as they are the largest cryptocurrencies by market capitalization and have significant adoption. They have stood true to the test of time and lasted through previous bear cycles. This makes them a more attractive bet during a bear market than other altcoins.

You can even choose to invest in stablecoins like USDT and secure your investment in dollars without it leaving the crypto market.

Think about HODLing

A safer bet while investing in a bear market would be to consider HODLing or holding on for dear life. Crypto enthusiasts coined this term, which refers to holding your investment and adding to it during bear markets. This strategy will help you accumulate your holdings and benefit from the subsequent bull market.

However, The risk with this strategy is that the price of the cryptocurrency you choose to HODL may never recover. This is, however, easier to mitigate by making smart investment decisions.

Consider short-term trading

If you choose to continue day trading even during a bear market, you can do so by short-selling cryptocurrency. This risky strategy includes borrowing cryptocurrency from an exchange and selling it. As prices drop, you buy and return the crypto to the exchange you borrowed from. Short-selling cryptocurrency can be a strategy for traders who understand the market and can predict price movements.

However, it also involves significant risks, including the potential for unlimited losses if the cryptocurrency price rises instead of falls. Additionally, short selling can be more challenging to execute in cryptocurrency due to its high volatility and lack of liquidity compared to traditional markets.

Stay updated about the latest events in the crypto market

During a bear market, it is crucial that you stay updated with the latest trends in the market. You will need to analyze behaviors and market sentiments and adjust your investment strategy as the market evolves toward the next bullish cycle. By not giving in to FUD and making rational decisions, you stand a better chance of saving your investment from tanking.

Here are some things you should never do during a bear market:

- During a bear market, do not invest blindly. Ensure that the time period of your investment is when the asset is at a new low before buying it. If you skip out on timing the market, your investments could be significantly affected.

- Do not give into FUD and engage in panic selling. This could seriously affect your investment and prevent you from benefiting when the market picks up during the next bull cycle.

- Do not forget to stay updated with your portfolio’s performance as the bearish trends intensify. This way, you monitor your investment and mitigate potential losses. You can also adjust or rebalance your portfolio as needed by studying the trends in the market.

- Investors who panic or give into the fear of missing out (FOMO) often have to bear big losses due to poor decision-making. They give in to the market’s pressure and sell their holdings before its time. You should, hence, not give in to FOMO and engage in panic selling.

- During a crypto bear market, social media platforms are filled with fear, uncertainty, and doubt, causing confusion and panic. It is important for investors to hence keep a calm mind before making big decisions regarding their investments.

- Do not be too aggressive in buying or selling crypto. A bear market is a period of correction and requires a strategy for navigation.

This article discusses how to best invest in cryptocurrencies during a bear market. You will need to stay updated and use a mix of strategies to survive the bearish trends until the subsequent bull market. A bear market does not necessarily mean a decline. It is the waiting period for preparing before the next bull market. With the right strategy and research, you can navigate bear markets and succeed.