- Litecoin could benefit from more scarcity with the upcoming halving.

- LTC bulls delivered a 7% upside, aided by whale activity, despite low investor sentiment.

Litecoin [LTC] will likely observe increased attention and possibly even higher demand in the next eight weeks. This is because of the upcoming halving, scheduled to take place in August 2023, which is the most significant event in the next two months.

Read Litecoin’s [LTC] Price Prediction 2023-24

Perhaps it is best to look into what the halving is all about because it may offer some insights into Litecoin’s future. The Litecoin network is one of the few proof-of-work networks in existence. This means it relies on miners to solve complex algorithms to facilitate the creation of blocks.

According to a recent post by the Litecoin Foundation, the network conducts a halving event once every four years or once after 840,000 blocks. The rewards given to miners for block creation are slashed by half during a halving event. For example, the reward issued to miners will be halved in August from 12.5 LTC to 6.25 LTC per block.

With the #Litecoin halving approaching, we created this video to explain more about this mathematical event, when it happens, how the reward system works and why is it so important. $LTC #crypto https://t.co/HEHZq5vV1M

— Litecoin Foundation ⚡️ (@LTCFoundation) May 27, 2023

The purpose of the halving mechanism is to ensure that LTC is inflation-proof. In other words, it ensures the scarcity of Litecoin’s circulating supply. This is particularly significant for LTC’s price action in the long term, especially as demand for the cryptocurrency continues to grow.

Fewer coins are released into the market with each halving. As such, growing demand for LTC, matched by a low circulating supply, means that demand may outweigh supply. This could be favorable to its price action in the long term.

LTC regain control in the short term

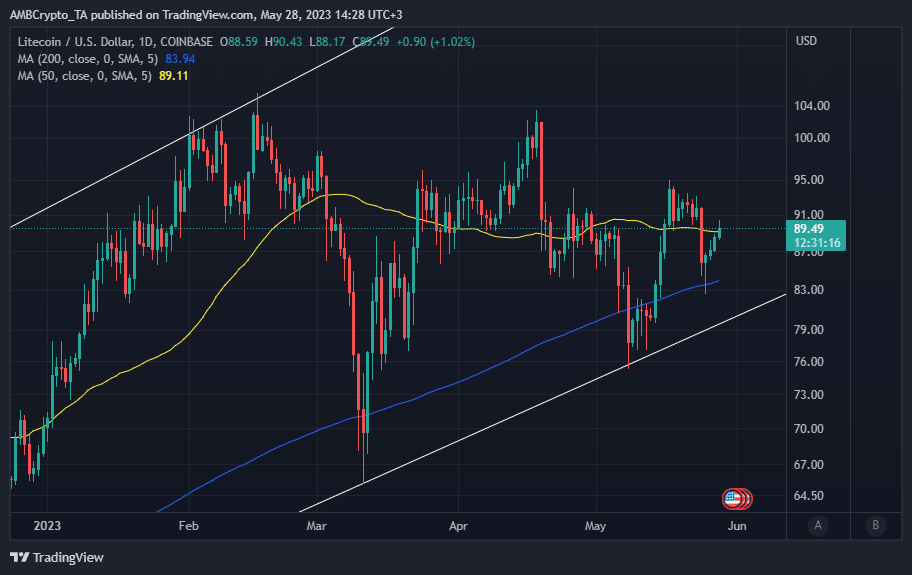

Litecoin’s short-term performance has also been quite interesting. It experienced a noteworthy pullback last week that threatened to wipe out previous gains and attempt another ascending support retest.

However, the bulls took over after a brief interaction with LTC’s 200-day moving average, and BTC was up by 7% in the last four days until press time. It traded at $89.49.

Source: TradingView

Interestingly, Litecoin’s on-chain volume fell drastically within those four days despite the rally. Is this an indication that LTC whales were buying at a time when retail traders were fearful after the recent bearish outcome?

Is your portfolio green? Check out the Litecoin Profit Calculator

Also, investor confidence fell substantially during the same 4-day period, as indicated by the weighted sentiment, which was at a weekly low at press time.

Source: Santiment

LTC’s press time bullish activity reflected its correlation with Bitcoin [BTC] and the rest of the crypto market. In short, Litecoin’s price action remained at the mercy of short-term waves of demand and sell pressure.