- MicroStrategy adds 122 BTC to its holdings, now totaling 214,400 Bitcoins.

- Despite negative broader Bitcoin metrics, there is a possible uptick on the horizon.

In a strategic addition to its cryptocurrency reserves, MicroStrategy, the software giant turned Bitcoin [BTC] advocate, has recently expanded its portfolio.

On the 30th of April, the company, under the leadership of founder Michael Saylor, disclosed the acquisition of an additional 122 Bitcoins, purchased for approximately $7.8 million.

This latest transaction elevates MicroStrategy’s total Bitcoin holdings to roughly 214,400 units.

This purchase was part of MicroStrategy’s ongoing commitment to Bitcoin, which has been a central aspect of their business model in recent years.

Also, despite the volatility and recent downtrends in the cryptocurrency market, MicroStrategy released its first quarter financial report for 2024, detailing their holdings at a valuation of $7.54 billion.

This values their extensive Bitcoin inventory at an average price of $35,180 per unit.

The firm has been consistently bullish on Bitcoin, accumulating 25,250 Bitcoins since the last quarter of 2023 at an average price of $65,232 per BTC.

Bitcoin’s bumpy road

Despite MicroStrategy’s optimistic accumulation, the broader market has continued to face challenges.

Bitcoin’s price has been on a downward trajectory, with a significant 4.5% drop over the past week.

Recent data from CoinGecko highlighted a 24-hour low of $61,890 for Bitcoin, though there was a minor recovery of 1.5%, bringing the price up to $63,226 at the time of writing.

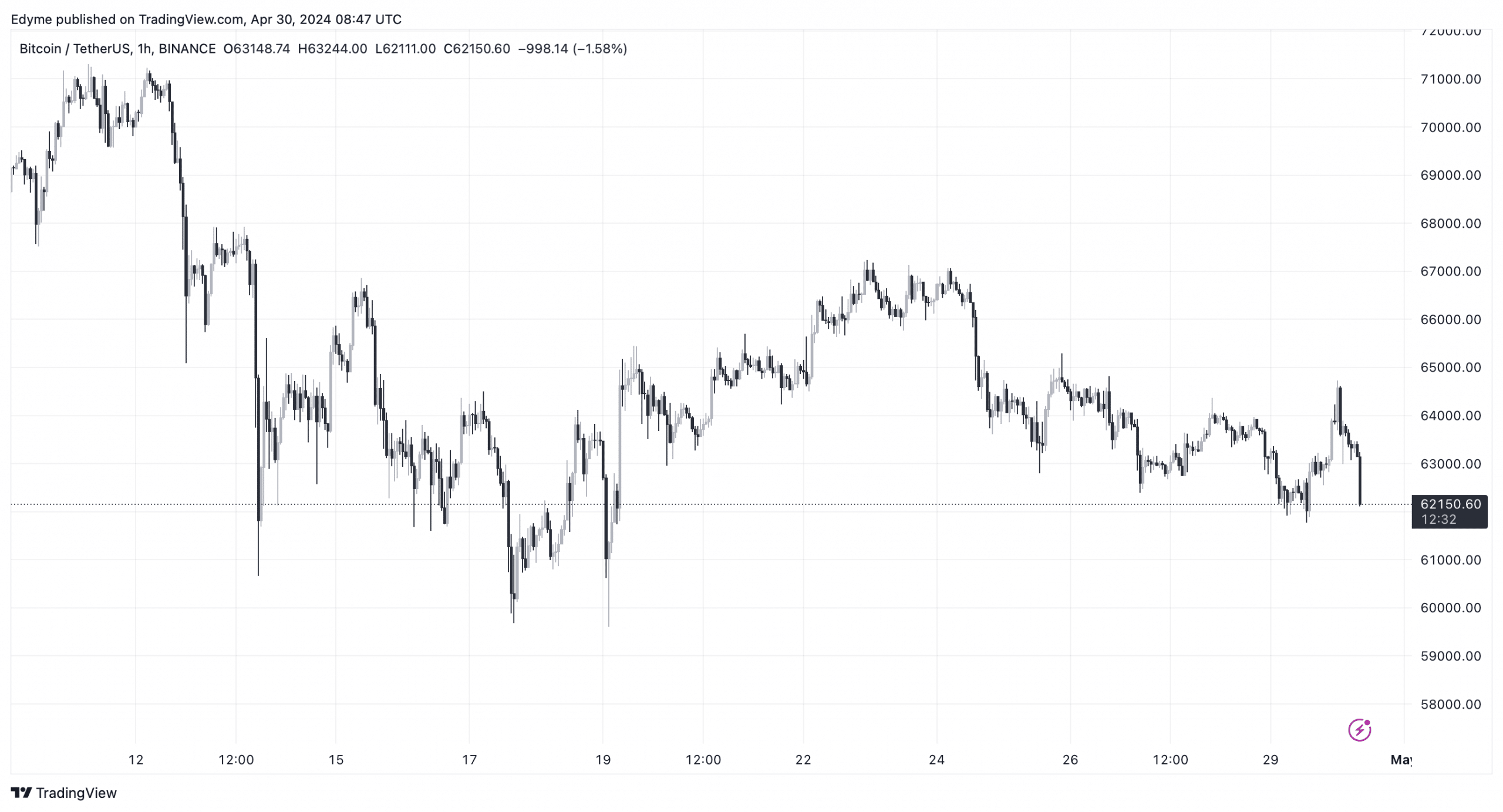

Source: TradingView

The ongoing challenges are not limited to immediate price fluctuations. A broader perspective revealed significant declines in several of Bitcoin’s core metrics, such as hash price, particularly following the cryptocurrency’s fourth halving event on the 20th of April.

Notably, the decline in Bitcoin’s price appears to be mirrored by a decrease in its hash price, which recently hit all-time lows.

It fell below $50 per PH/s per day for the first time ever, signaling a tough period for miners, whose profitability is now severely squeezed.

Source: Hashrate Index

This decline has not only affected the profitability of mining operations but has sparked concerns over the long-term viability of mining, contributing to negative investor sentiment.

However, amidst the prevailing bearish trends, some analysts remain bullish about Bitcoin’s future prospects.

AMBCrypto, for instance, suggested that while the near-term outlook may see Bitcoin testing support levels around $61k, a successful rebound from this point could trigger a new bull rally.

Such a rally could potentially push prices to reclaim $66k, and possibly even escalate to $71k in the lead-up to achieving new record highs.