NFT

NFTs, or non-fungible tokens, have evolved from a niche market confined to cryptocurrency enthusiasts to a disruptive force predicted to redefine the global economy.

The NFT market is set to surpass the $200 billion mark in the near future, transforming how value and ownership are perceived in both the digital and physical worlds.

The Unstoppable Force of Digital Assets

In 2022, the NFT market held a staggering worth of $20.44 billion. This accounts for over 72% of the global revenue of the digital assets market.

Forecasts predict an impressive compound annual growth rate of 34.2% from 2023 to 2030. Consequently, indicating that the surge in the value of digital assets has been phenomenal.

This trend is largely fueled by the unique nature of NFTs that allow artists to retain ownership of their creations while profiting from their work. The newfound financial independence draws creatives worldwide to the digital asset segment, driving growth.

The concept of digital real estate is also gaining traction. Both physical and virtual properties are being tokenized and traded on NFT platforms. This is making real estate a significant contributor to the digital asset segment.

Moreover, NFTs have emerged as a powerful tool to combat fraudulent transactions. They offer higher security and transparency previously unachievable in the digital landscape.

Each NFT is unique, indivisible, and can be traced back to its original creator. Consequently, establishing the authenticity of the digital asset and offering an unprecedented level of security to buyers.

Revolutionizing Ownership of Physical and Digital Collectibles

The physical asset segment, which includes tangible items such as houses, paintings, and vehicles, is predicted to witness substantial growth in the near future as well.

When tokenized into NFTs, these physical assets offer a foolproof way to authenticate the owner’s identity and safeguard against fraudulent transactions. This innovative application of NFTs extends their reach, promising a revolution in the traditional models of ownership and value.

“Decentralized financial systems hold promise to dismantle some of the constraints found within TradFi, and in turn, deliver material improvements in regards to market efficiency and opportunities for asset holders. DeFi minimizes or completely cuts out the intermediation systems found in TradFi to effectively decentralize the back-end of financial markets,” noted Binance Research.

NFTs have also had a profound impact on the collectibles sector. Holding more than 53% of the global NFT revenue in 2022, crypto collectibles, minted on NFT marketplaces, have become a sensation among various demographics.

The possibilities, be it sports memorabilia, unique game assets, or exclusive artwork, seem endless.

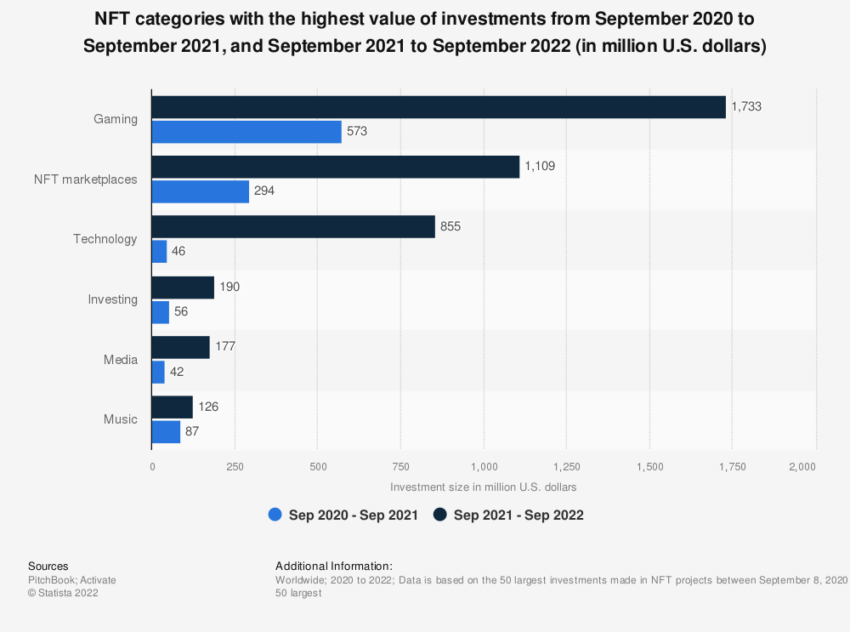

NFT Categories With Highest Investment. Source: Statista

This trend is driven by the increased capacity of NFTs to foster a direct connection between creators and fans. It has enabled them to trade, engage, and build a community around their shared interests.

The level of personal engagement and ease of handling these digital assets are the major factors contributing to the explosive growth of the collectibles segment.

The Rising Influence of NFTs in the Sports Sector and Beyond

NFTs have also made significant inroads into the sports sector. They are creating new avenues for athletes to boost their brand visibility and enhance fan engagement.

Up to five million sports fans are estimated to own or be gifted an NFT, generating over $2 billion in transactions. This considerable uptick from the previous year signifies the vast potential of NFTs in driving fan engagement and revenue generation in the sports sector.

Even Nike has recognized this trend and recently partnered with Electronic Arts to bring NFTs into future EA Sports games. The goal is to allow “members and players unique new opportunities for self-expression and creativity through sport and style.”

“Nike’s new partnership with EA Sports will look to build new immersive experiences and unlock brand new levels of customization within the EA Sports ecosystem,” reads the press release.

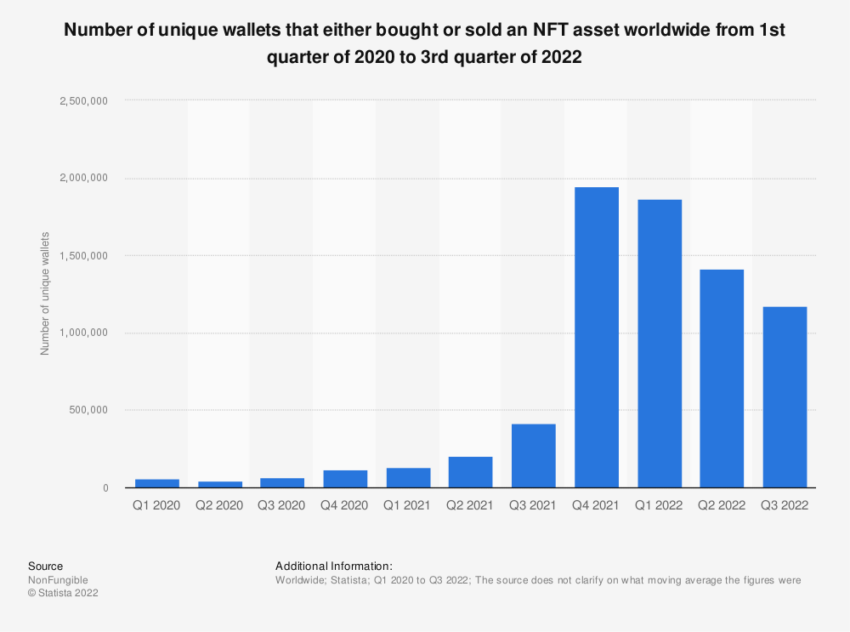

Unique NFT Users Worldwide. Source: Statista

Still, the potential of NFTs extends beyond art and sports. Traditional sectors like music, fashion, and gaming increasingly incorporate NFTs to offer their fanbase unique experiences and exclusive digital content.

NFTs have also found their way into the commercial sector. They are innovating supply chain management and logistics and fostering new growth opportunities.

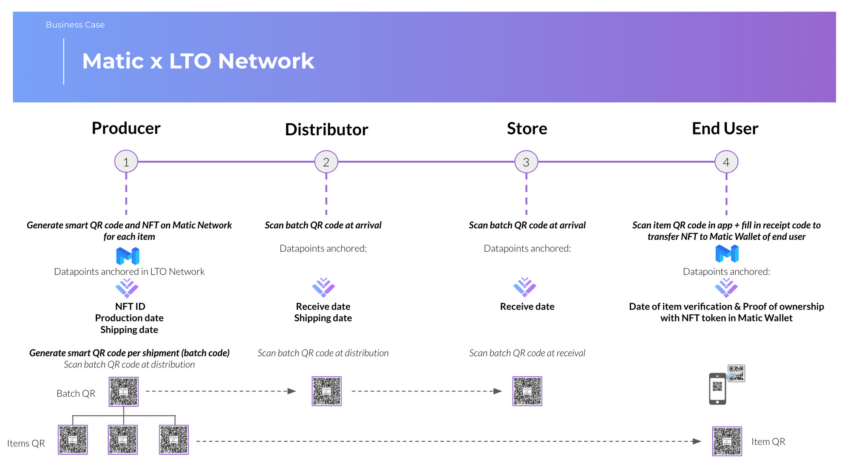

Yuri Musienko, Business Development Manager at Merehead, believes that at the heart of supply chains, NFTs are the gatekeepers, confirming the authenticity of products and certifying their quality and provenance.

“For instance, your clients should check the storage conditions and source if you sell food. NFTs make it significantly more straightforward thanks to special sensors that will track via GPS the temperature, humidity, etc., and then it will record the data into the blockchain and link it to the NFT of the product,” affirms Musienko.

NFTs in Supply Chain Management. Source: LTO Network

Moreover, the COVID-19 pandemic has served as an unexpected catalyst for the NFT market. During the pandemic, the surge in funding for Art+Tech startups showcased the potential of NFTs to transform the art industry.

“The COVID-19 pandemic completely changed the picture for us – we saw a rapid increase in interest in virtual exhibitions. That situation forced us to pivot, and we started helping galleries to create virtual exhibitions on the web,” said Vitomir Jevremovic, CEO of All.Art.

Likewise, Fuelarts reported that Art+Tech startups raised around $380 million since the start of 2020, indicating accelerated market growth during the pandemic.

“The total funding for 249 Art+Tech startups amounted to $3.48 billion in 2022, which compounds to 70.8% of the total funding received by these startups since their launch and 49.3% of the cumulative investments in the Art+Tech industry since 2000,” noted Fuelarts.

A Promising Future for NFTs

As the world stands on the precipice of a digital revolution, the NFT market’s projected growth to $200 billion signifies a transformative shift.

However, one significant challenge remains: educating the general population about the concept, value, and authenticity of NFTs.

A coordinated effort by NFT platforms, creators, and established brands can help overcome this hurdle and usher in the era of NFTs in the mainstream economy. The future of NFTs is bright and promises to be a game-changer in the global economic landscape.