- Bitcoin’s network saw more NFT sales than Ethereum’s over the past week.

- Floor prices of BAYC and CryptoPunks fell to multi-month lows too

The sales volumes of non-fungible tokens (NFTs) on the Bitcoin [BTC] network surged last week, exceeding that of Ethereum [ETH], according to data from CryptoSlam.

Over the aforementioned period, Bitcoin’s NFT sales volume totalled $43 million, rising by 26%. Although Ethereum’s weekly NFT sales volume also rose by 17%, it amounted to “just” $40 million.

This, notwithstanding the fact that 99,297 NFT transactions were completed on Ethereum last week. Bitcoin, on the other hand, recorded 55,351 NFT transactions.

Over the last 14 days, the total value of all NFTs sold on the Bitcoin network was $77.02 million. According to CryptoSlam, Ethereum’s NFT sales volume over the same period was $71 million.

State of the NFT market

The previous week was marked by a decline in the general cryptocurrency market. In fact, global cryptocurrency market capitalization dropped by 4% in just 7 days.

This decline affected the NFT ecosystem, which also fell in value. According to NFTGo, last week’s NFT trading volume amounted to $85.39 million, dropping by 3% on the charts.

This led to a fall in NFT market capitalization – worth $7 billion at press time – after depreciating by 11% in the last seven days.

Source: NFTGo

Floor prices hit new lows

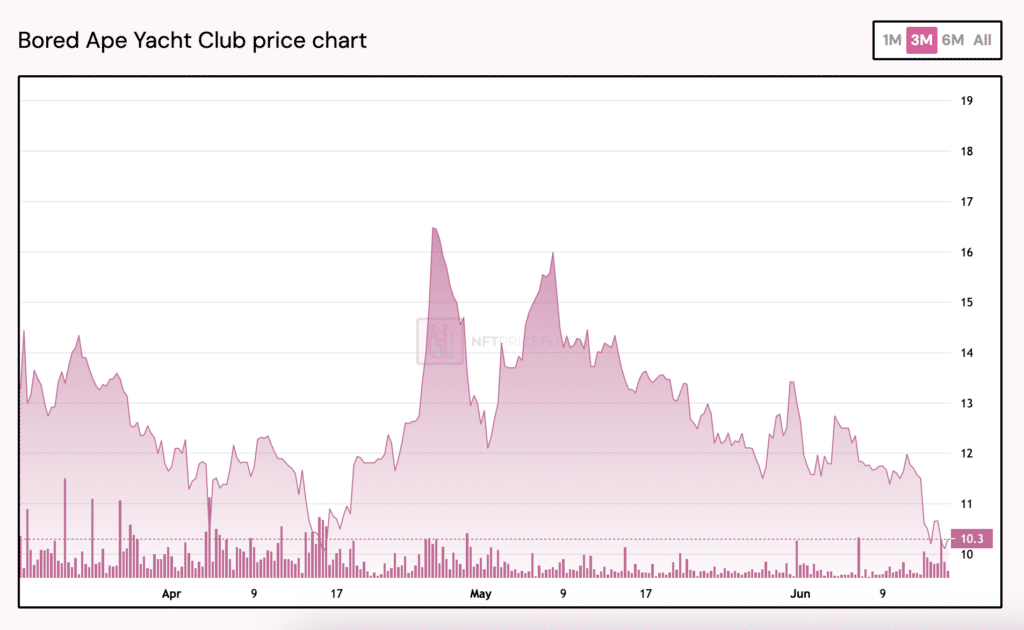

A look at the leading NFT collection, Bored Ape Yacht Club (BAYC), revealed a decline in its floor price over the past few weeks.

After peaking at 13.7 ETH on 31 May, the floor price of an NFT in the BAYC collection has since declined by 25%, as per NFTPriceFloor.

The last time BAYC’s floor price was this low was on 15 April.

Source: NFTPriceFloor

Over the past month, BAYC has seen a decline in sales volume as the daily count of traders buying and selling NFT pieces from the collection decreased. In the last 30 days, BAYC’s sales volume totalled $12 million, having plummeted by 34%.

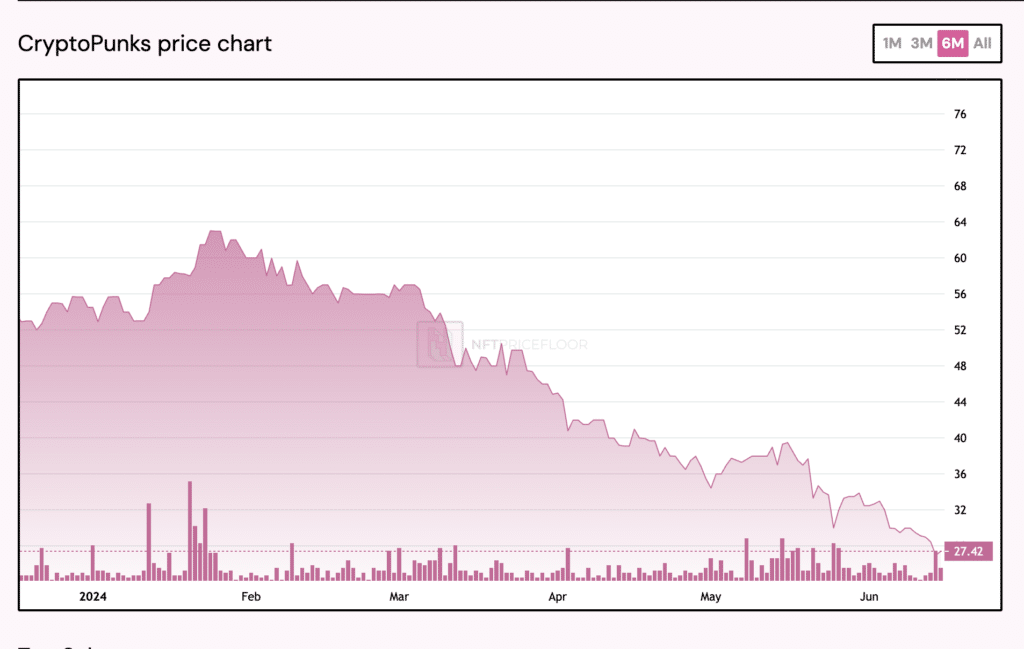

As far as the CryptoPunks NFT collection is concerned, its floor price was 27.42 ETH at press time, representing its year-to-date lowest.

Source: NFTPriceFloor

After peaking at 63 ETH on 24 January, the average price of an NFT in the collection has since fallen by a massive 57%.