A Coinbase researcher says the impact of a potential regulatory greenlight for a US spot Bitcoin (BTC) exchange-traded (ETF) has already been “partially priced in” for the top crypto asset.

In a new analysis, David Duong, head of institutional research at the crypto exchange, says that the divergence between the performance of Bitcoin and the altcoin market suggests that market participants are already anticipating the approval of one or more BTC ETFs.

According to Duong, Bitcoin may not rally as hard as traders expect it to when a spot-based ETF gets the nod since the highly anticipated event is already partially priced in.

“That makes it less clear how much more Bitcoin could outperform if a favorable U.S. Securities and Exchange Commission (SEC) decision occurs.”

Duong also says that if a BTC ETF is approved, it might take some time for significant inflows to materialize, comparing the scenario to a previous gold ETF approval.

“For example, the SPDR Gold Shares ETF (GLD) was a pioneer in the US gold exchange-traded products market when it launched on November 18, 2004, almost 19 years ago. In hindsight, GLD has been a widely successful financial product with total assets of $51.4 billion today, according to Bloomberg. However, if we look at its metrics, GLD attracted only $1.9 billion in net inflows (inflation-adjusted to today’s dollars) within the first 30 days of launch and only grew that to $4.8 billion within the first 12 months of its life.”

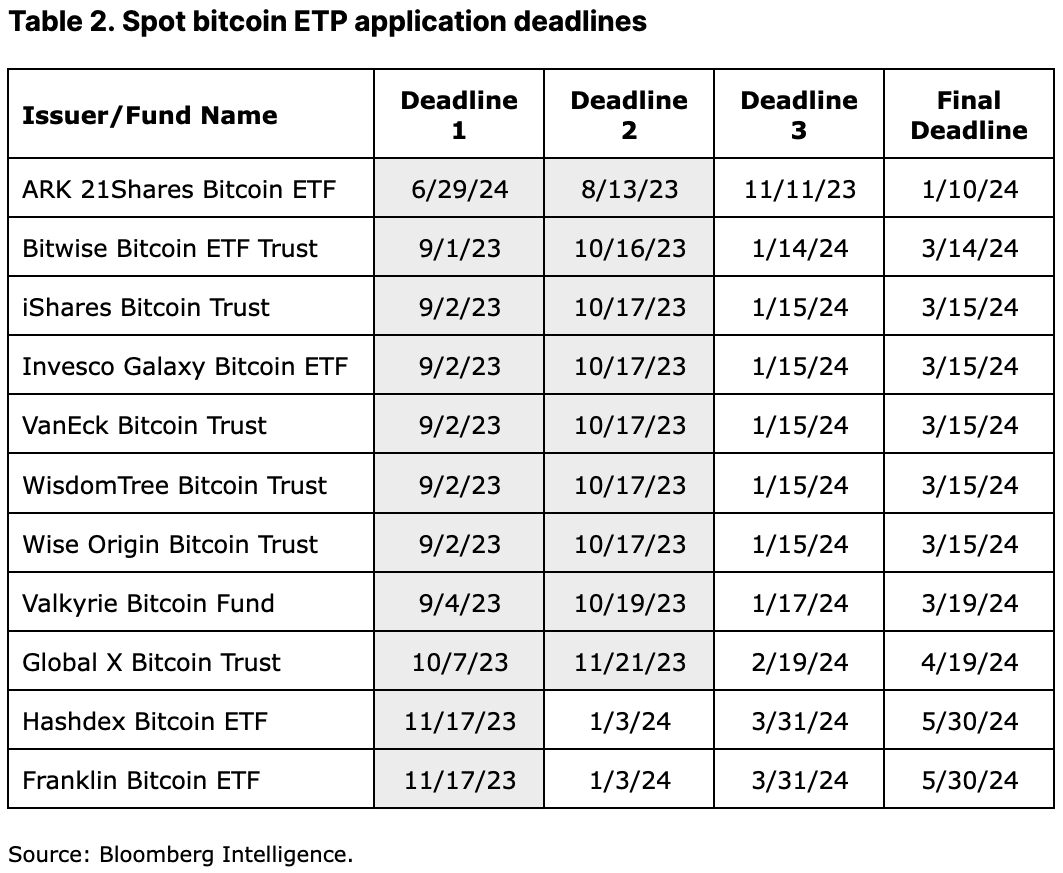

The U.S. Securities and Exchange Commission (SEC) delayed decisions on a slew of spot BTC ETF applications, including BlackRock’s, in late September.

However, the final deadline for the SEC to review one application, the ARK 21 Shares Bitcoin ETF, is on January 10th.

Duong says that the ARK 21 Shares Bitcoin ETF deadline could encourage the SEC to issue decisions on a number of applications this year.

“We believe that barring a US government shutdown, it’s entirely possible that we may see the SEC make a decision before the end of 4Q23. Otherwise, that puts the SEC in the awkward position of possibly deferring its decision on a subset of filings on January 3, 2024, right after the holidays, only to address a final deadline decision for one ETF filing days later on January 10. To avoid sending mixed messages, we think the SEC could decide to collectively address these applications in December 2023.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney