Although the cryptocurrency sector has been going through a rough patch, its collective market capitalization threatening to drop below $1 trillion, some of its assets, particularly Solana (SOL) and Cardano (ADA), have performed better than others in terms of risk-adjusted returns.

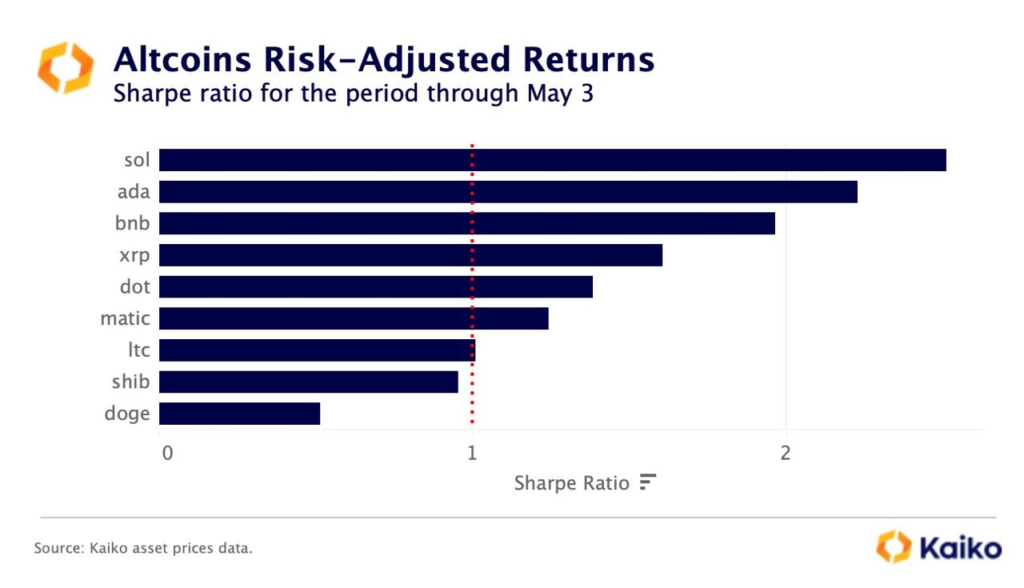

Specifically, among the top altcoins by market cap, Solana and Cardano, have recorded the highest year-to-date risk-adjusted returns for the period through May 3, as measured using the Sharpe ratio, according to the data published by crypto market analysis platform Kaiko on May 9.

What does this mean?

As the platform’s analysts explained, “the Sharpe ratio measures the excess return of an asset per unit of volatility, with a ratio of 1 or above generally considered good.” Indeed, both Cardano and Solana had a Sharpe ratio of above 2, which means their investors are taking on lower risk compared to the reward.

Following the two top performers are BNB (BNB) – the native token of the crypto trading platform Binance, XRP (XRP) – the native cryptocurrency of the blockchain company Ripple, as well as the cross-chain protocol Polkadot (DOT), scaling solution Polygon (MATIC), and peer-to-peer cryptocurrency Litecoin (LTC), all with a Sharpe ratio of above 1.

Meme coins are more risky?

Meanwhile, meme-inspired digital assets Shiba Inu (SHIB) and Dogecoin (DOGE) both have a Sharpe ratio of below 1, making them the poorest performers on the list of top altcoins by market cap in the sense of risk-adjusted returns. According to the Kaiko analysis:

“In contrast, meme tokens like Dogecoin and Shiba Inu have been the worst performers, with a ratio below 1. This implies that meme coin investors are taking on more risk relative to the compensation received.”

That said, Solana and Cardano have had similar price trends in the past week as Dogecoin and Shiba Inu, as they all suffered losses. In fact, SOL declined 7.75%, ADA 7.97%, DOGE 7.51%, and SHIB 11.41% during that time.

However, interestingly, both DOGE and SHIB have witnessed slight increases over the previous 24 hours, climbing 0.52% and 0.88%, respectively, during which time SOL and ADA saw the opposite – the former dropped 0.27% and the latter 0.73% on the day.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.