- Solana ETFs approved by Brazil, set to begin trading this month.

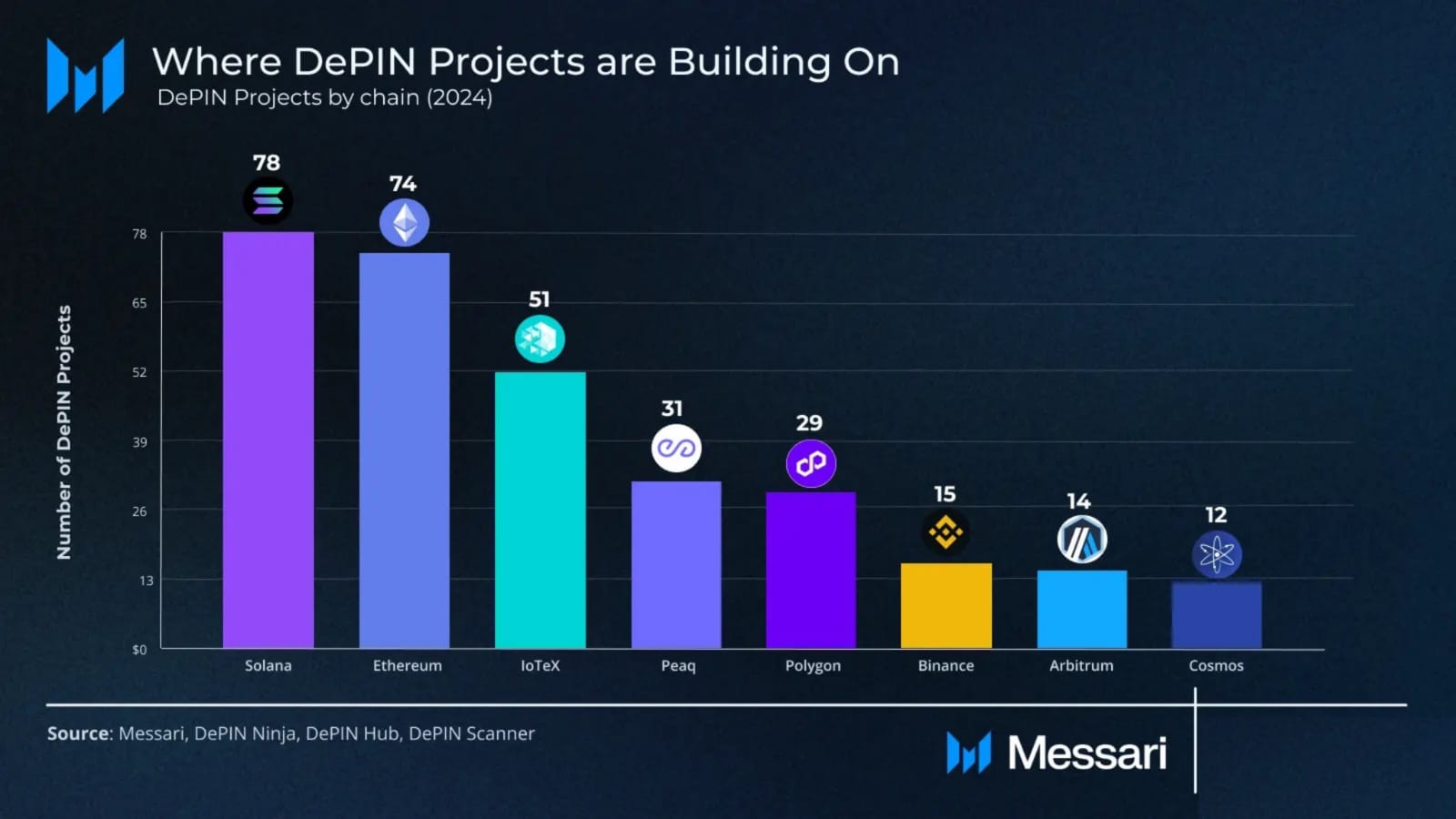

- Most DePIN projects are built on the Solana blockchain.

Brazil has taken a significant step towards global cryptocurrency adoption by approving the world’s first Solana [SOL] spot ETF.

This new fund is set to begin trading in August, as reported by Solana Floor on X (formerly Twitter).

While major financial hubs like the U.S. and UK have not yet approved Solana ETFs, the delay is expected to be temporary as they’ll eventually approve Solana ETFs, allowing them to be traded on their markets.

Solana dominates DePIN sector

SOL is leading the DePIN sector with 78 projects, outperforming all other blockchain networks.

This highlighted Solana’s growing dominance over Ethereum [ETH], suggesting it may become the preferred blockchain for development.

Although Ethereum remained close behind, Solana’s lead was evident, with a 4% higher usage rate in DePin projects, according to Messari Crypto Research.

Source: Messari

TVL rebounds by 20% after fall

Circle has recently minted $250 million in USD Coin [USDC] on Solana, which constituted about 70% of the stablecoin supply on the platform at press time, compared to just 30% on Ethereum.

PayPal’s PYUSD, launched less than two months ago, already makes up around 11% of Solana’s stablecoin supply.

The dominance of USDC on Solana is due to efforts by Circle and the Solana Foundation to attract developers and integrate trading platforms.

The launch of Circle’s CCTP on Solana has also improved USDC’s usability and liquidity. Despite recent declines, Solana’s total value locked (TVL) has rebounded by 20%.

Source: DefiLlama

SOL/ETH price action makes a new ATH

The latest data shows that the SOL/ETH trading pair has reached a new ATH, despite Solana experiencing bigger losses during the recent market downturn.

This notable achievement for SOL might prompt investors to reconsider their long-term views on both Solana and Ethereum.

Despite the recent volatility and SOL’s decline, its new high against ETH suggests that the dynamics between these two cryptocurrencies are shifting, making it a critical moment to reassess investment strategies for both.

Source: TradingView

ETH gets smoked by SOL on the rebound

SOL surged over 13% in value, while Ethereum has dropped by 1.03% after the crash.

Realistic or not, here’s SOL’s market cap in BTC’s terms

This sharp contrast in performance highlights Solana’s strong momentum compared to ETH.

Given this recent trend, Solana’s impressive gains suggested it could significantly outperform Ethereum in the current market cycle.

Source: Messari