Solana (SOL) has been struggling to strongly hold above the $110 mark over the past week. The recent price drop has resulted in its capitulation to BNB again.

SOL declined by 3.8% in the past 24 hours and is trading at $109.5 at the time of writing. The asset’s market cap fell from around $50 billion to $47 billion over the past day — making it the fifth-largest cryptocurrency.

Solana’s 24-hour training volume, however, recorded a 16% surge, reaching $3.3 billion.

Per a recent report, the Solana network surpassed Ethereum’s weekly stablecoin trading volume. Solana’s seven-day stablecoin volume reached $103 billion while Ethereum’s number was hovering around $90 billion.

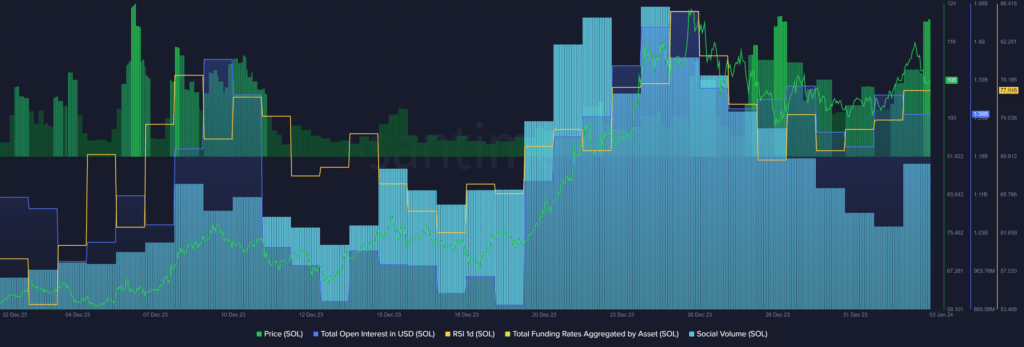

According to data provided by Santiment, the social activity around the SOL token surged by 76% over the past day after consistently declining since Dec. 24.

On the other hand, the total open interest (OI) in Solana dived $1.3 billion to $1.26 billion over the past 24 hours, per Santiment. The declining OI could suggest that roughly $40 million worth of SOL perpetual contracts have been either closed or liquidated at this price point.

According to Santiment data, the total funding rates aggregated by SOL currently stands at 0.08%. This indicator shows that long-position holders are dominating the short-position holders at this price point.

Moreover, the Solana Relative Strength Index (RSI) has been constantly rising since Dec. 30. Per Santiment, SOL’s RSI just reached a seven-day-high of 77.

While the majority of traders are betting on long positions, the RSI indicator suggests high price volatility.

According to a report on Jan. 1, Solana’s decentralized exchange (DEX) volume surpassed the $28 billion mark in December. The rally was triggered by a series of airdrops and meme coin mania, which also helped the SOL token reach $120 in late December.