The year 2024 started with the rising price of Bitcoin like a rising dragon. The market has been volatile since the beginning of the year due to the US SEC’s approval of Bitcoin spot ETFs. The first rating update was made on January 10th in 2024, which marks the beginning of spring for crypto assets. Let’s take a look at the results.

Rating results overview

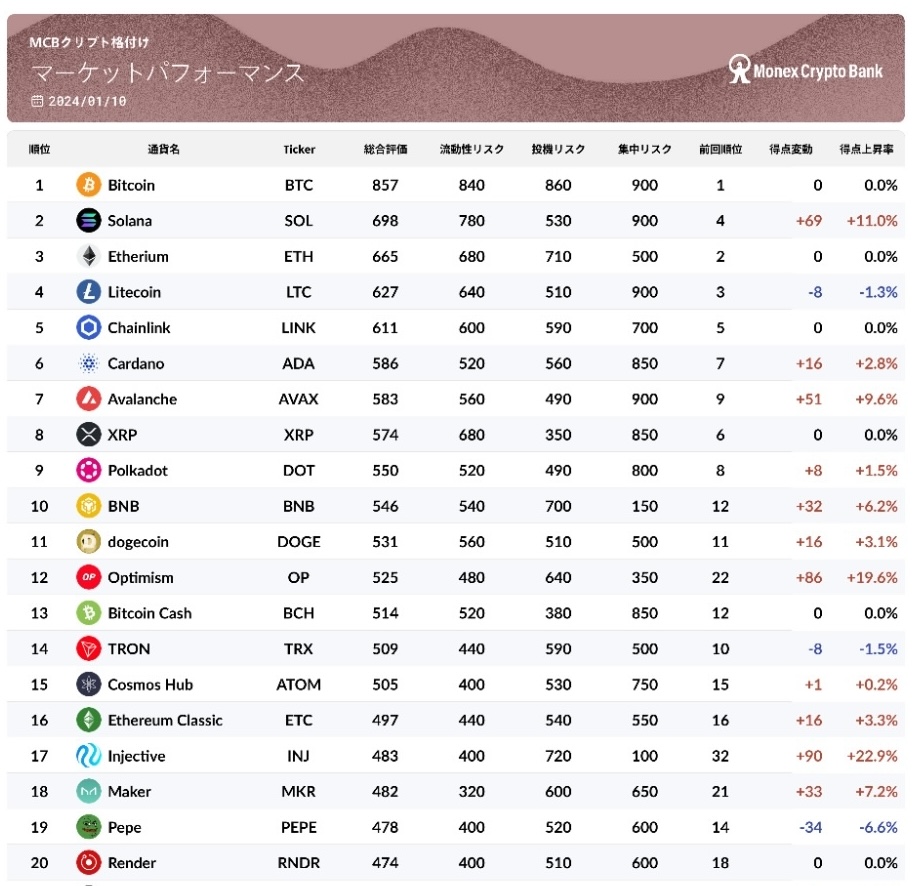

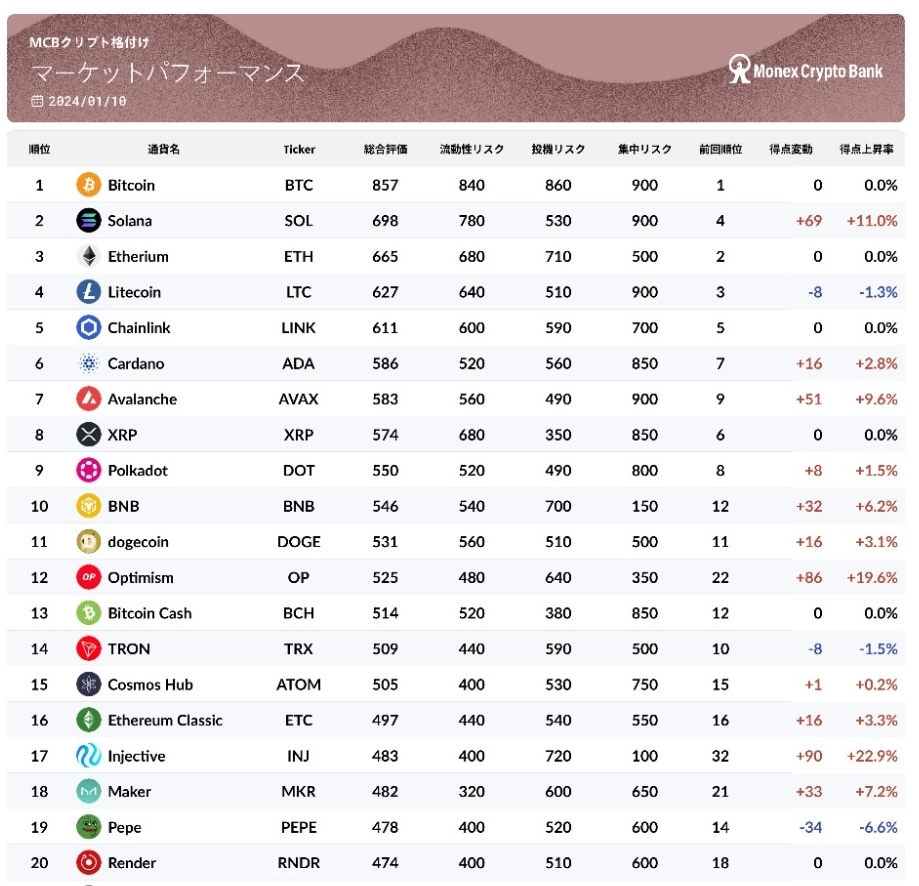

Let’s start with the overall impression. In first place was Bitcoin[BTC]with 857 points. As mentioned in this article, Solana[SOL]overtook Ethereum[ETH]which was in second place, and rose to second place with 698 points. Cardano[ADA]and Avalanche[AVAX]also steadily increased their points and jumped to 6th and 7th place respectively. On the other hand, Ripple[XRP]which was in 6th place last time, dropped to 8th place. Also, TRON[TRX]was the only one not ranked in the top 10, coming in 14th place. In its place, Binance Coin[BNB]rose from 12th to 10th place.

Many of the stocks that were in the top 10 last time saw their prices decline towards the end of last year. The overall market price has risen due to a series of upsurges in Bitcoin ETFs, but there are only a few stocks that have surpassed the December 2023 rating reference date, and BTC, ETH, and SOL are the only stocks whose prices have become positive compared to the same rating reference date. It was just the brand.

speculation risk

However, the overall ratings of many stocks are gradually increasing. Five of the top 10 stocks increased their overall scores. Two stocks, Litecoin[LTC]and TRX, were negative, but the fluctuations were small. A major factor behind this is that the evaluation of speculative risk has become positive overall. Items such as volatility, Sharpe ratio, and ROI are taken into consideration for speculative risk, and 27 out of 48 stocks scored higher in these items, exceeding 50%. This is largely due to the rise in the overall market price, but looking at each item, Optimism[OP]and Injective[INJ]are speculative risk items, respectively, and they rose by +170 points and +180 points, compared to the increase in other stocks. I have accumulated high scores compared to others. These two stocks also improved their scores in terms of liquidity, and were by far the top two in terms of score increase rate. The prices of OP and INJ have soared by 70% to 100% since the previous rating reference date, and it can be said that such a large increase was highly evaluated in this rating.

Liquidity

In terms of liquidity, the three stocks with the highest scores were SOL, which will be mentioned below, as well as ASTR and AVAX. SOL and AVAX entered the meme coin boom in December last year. At SOL, the dog-themed brands Dogwifat[WIF]and Bonk[BONK]are driving the boom, while at AVAX, the chicken-themed Cock Dog[COQ]is driving the boom. The network trading volume more than doubled compared to last month, and the number of active wallets and new users increased, which is considered to have greatly contributed to the improvement in liquidity evaluation.

On the other hand, a major reason for ASTR is that it was listed on Upbit, South Korea’s largest cryptocurrency exchange. After going public, the price at one point doubled. The company is expanding its business in South Korea, including listing on bithumb in South Korea in September last year, which shows that there is growing interest in ASTR in the country.

Due to these factors, SOL improved its overall ranking from 4th to 2nd, AVAX from 9th to 7th, and ASTR from 36th to 27th. By the way, this article only lists rankings up to 20th place, but there are many notable stocks like ASTR even after 21st place. Please check out the complete version, which includes rankings for all 48 stocks, on our website.

concentration risk

The four stocks that received the highest scores for concentration risk were BTC, SOL, LTC, and AVAX. Including these, 41 out of 48 stocks had no increase or decrease in concentration risk scores from last month. Concentration risk evaluates whether or not tokens are concentrated in a specific wallet, so it will not fluctuate significantly unless a whale holding it for a long time moves a large amount. On the other hand, it is important to be careful when the concentration risk assessment changes significantly.

Under such circumstances, there are two stocks whose scores decreased by more than 100 points. They are Phantom[FTM]and Zirika[ZIL]. These stocks have a large concentration of token holders, so please pay close attention to the trends of wallets that hold large amounts. On the other hand, only Maker[MKR]and AAVE[AAVE]increased their points. These two stocks appear to have more diversified ownership. By the way, if we were to invest in each stock based on the score of the top 10 stocks that were highly rated in terms of concentration risk, we calculated that we would have gained about 3%. Overall, there are many stocks whose prices have fallen compared to the previous reference date, and this result can be said to suggest the importance of decentralization, which is the essence of blockchain. Please note that FTM, ZIL, and AAVE are not ranked in this article because they are ranked 21st or lower.

Highlight: Solana overtakes Aether to take 2nd place! What is the background?

The most eye-catching thing in this ranking is that Solana overtook Ethereum, which held the steady second place. Because full-scale ratings are basically evaluated from a long-term perspective, short-term booms are less likely to cause major fluctuations in scores, and this is especially noticeable for stocks that are originally ranked high. Despite this, the fact that it has quickly increased its score and overtaken Ethereum shows that Solana’s expected return value and utility have increased significantly over the past month.

The rise in price over the past month was especially rapid, but if you look at the chart, you can see that it has been steadily increasing since around Nakazumi in October last year. The impact of the meme coins mentioned earlier will be quite large. In particular, BONK has played a large role in driving the excitement of the entire Solana ecosystem, and not only the SOL token but also the used price of the web3 smartphone “Saga” produced by Solana Labs, the main developer of Solana, has soared. On December 16th, Solana Mobile’s official X account announced that Saga was sold out, which became a hot topic. The reason why Saga sold so well was due to the existence of BONK, and it seems that many people were buying it for the BONK airdrop, which is exclusive to Saga users.

Solana slowed considerably due to the FTX shock in 2022, but in 2023, the pace of new product launches accelerates, on-chain liquidity increases, and the availability of developer tools expands, all coinciding with the meme coin boom. , it seems to have suddenly exploded at the end of the year. Solana, which came in second place in the official rating, seems to have great expectations for 2024.

This year’s outlook

It feels like this rating was a prediction of 2024, which began with the dawn of spring for crypto assets. In addition to the overall evaluation, if you pay attention to the fluctuations in the evaluation of each item, you will be able to see the stocks to watch this year. In particular, we must keep an eye on how the ratings of the aforementioned SOL, OP, INJ, and ASTR will change in the first half of this year.

Since the rating is based on a long-term perspective, it cannot be said that the true value of the rating has been demonstrated in just one month after the start of the rating.However, over the past year, we have been evaluating and improving the rating results, and we are evaluating the market performance of each project. We intend to improve this so that users can be convinced that it is appropriate. Unlike 2023, when the bull market was concentrated on Bitcoin, 2024 is expected to be a year in which altcoin buying and selling will be active. We would appreciate it if you could check the ratings as well as the market prices and news.

|Editing: CoinDesk JAPAN Editorial Department

|Image: Manec Script Bank