Solana, the blockchain platform known for its lightning-fast transaction speeds and growing DeFi ecosystem, is making headlines once again. As of this Monday, Solana’s Total Value Locked (TVL) has surged to an impressive $338.82 million, marking its highest point since the beginning of the year.

Meanwhile, Anatoly Yakovenko, co-founder of Solana, took to social media to criticize Ethereum, one of the leading players in the space. Yakovenko’s pointed remarks, in which he described Ethereum as a “novel spectacle of bourgeois upheaval,” have sparked a spirited debate within the cryptocurrency community about the ideologies and directions of these two prominent blockchain platforms. In response to Yakovenko’s critique, Ethereum’s co-founder, Vitalik Buterin, offered his perspective on Solana, sparking discussions about the philosophies, practicalities, and potential social impact of blockchain technology.

Solana’s TVL Reaches $338.82 Million, Highest Since the Start of the Year

Solana’s resurgence in the decentralized finance (DeFi) space continues as its Total Value Locked (TVL) reached $338.82 million this Monday, marking a significant milestone since the beginning of the year, according to data from DefiLlama. Although this metric is considered somewhat crude, it provides insights into the amount of capital flowing through a network’s various DeFi applications.

Solana’s TVL experienced a notable increase of approximately 4.15%, surging from $324.64 million on Sunday to its 2023 peak on Monday. Driving this upswing are popular projects built on the Solana blockchain, such as Drift, marginfi, Solend, and others.

However, it is worth noting that these numbers are still a far cry from Solana’s peak during the previous bull market. In November 2021, Solana’s TVL skyrocketed to just over $10 billion before experiencing a sharp decline. In January 2023, it bottomed out at $210 million.

Concerns are now emerging about the potential impact on Solana’s price following the approval for the FTX estate to sell its cryptocurrency holdings. The FTX estate reportedly holds approximately $1.2 billion worth of SOL tokens. According to market analysts at The Tie, a significant portion of this amount, around 22 million SOL tokens, valued at roughly $400 million, are now unlocked and available for sale. This represents nearly 4% of Solana’s total supply.

Additionally, there are between 40 million to 44 million SOL tokens, equivalent to approximately $860 million, currently staked. Furthermore, an additional $17 million worth of SOL tokens are expected to be unlocked every month for the next four years.

Solana was one of the projects most heavily impacted by the collapse of FTX. The Solana Foundation, in a blog post from November 2022, revealed its financial ties with FTX. The foundation had around $1 million in cash or similar assets with FTX until 6 November 2022, when the platform halted customer withdrawals. Importantly, this amount represented less than 1% of the foundation’s total funds.

In addition to the cash holdings, the Solana Foundation also owned approximately 3.24 million shares in FTX Trading LTD, as well as about 3.43 million FTT tokens and 134.54 million SRM tokens from Project Serum, a decentralized exchange on Solana launched by Sam Bankman-Fried in 2020.

As Solana’s TVL continues its upward trajectory and the FTX estate begins selling its SOL holdings, the cryptocurrency community will closely monitor the potential impact on Solana’s price and overall market sentiment.

Solana Co-Founder Anatoly Yakovenko Criticizes Ethereum

In a recent social media discourse, Anatoly Yakovenko, co-founder of Solana, took a swipe at Ethereum, describing it as a “novel spectacle of bourgeois upheaval” rather than a genuine revolution in the blockchain space. Yakovenko’s critical remarks ignited a debate within the cryptocurrency community about the direction and philosophies of leading blockchain platforms.

Yakovenko argued that Ethereum perpetuates a form of digital tyranny, asserting that it imposes a different but equally oppressive boot on the “toiling masses.” He emphasized the need for a truly stateless digital realm where the cost of state creation is negligible. According to him, this would emancipate individuals from capitalist intermediaries and state surveillance, aligning more closely with the principles of decentralization and accessibility that are foundational to blockchain technology.

This critique did not go unanswered. Vitalik Buterin, Ethereum’s co-founder, had previously acknowledged the Solana ecosystem, noting that “smart people” have told him Solana has an “earnest” developer community. Buterin’s comment, although somewhat ambiguous, appeared to be a subtle nod of approval toward Solana. It also left room for interpretation, as it refrained from directly endorsing or opposing Yakovenko’s views.

While Yakovenko’s criticism pointed out what he perceives as shortcomings in Ethereum’s approach to decentralization, it also raised questions about Solana’s own trajectory. Some observers argue that Solana has, to some extent, become a “VC’s blockchain” rather than a “people’s blockchain,” given its substantial financial backing from venture capitalists.

Buterin’s acknowledgment of Solana’s “earnest” developer community takes a more diplomatic stance. It recognizes Solana’s contributions to the blockchain space without necessarily passing judgment on its underlying philosophy. However, it also subtly implies that having an “earnest” community does not automatically make Solana revolutionary or superior to Ethereum.

Both Yakovenko and Buterin raise compelling points. Yakovenko’s critique prompts a reflection on the social impact of blockchain technology and the need to strive for true decentralization and accessibility. Buterin, on the other hand, appears to focus on practicality and acknowledges that an “earnest” community can bring about meaningful changes, even if it does not align perfectly with everyone’s ideological expectations.

The ongoing discourse between the co-founders of Solana and Ethereum highlights the diversity of thought within the cryptocurrency community. It also underscores the evolving nature of blockchain technology and the ongoing quest for innovation and improvement, as blockchain platforms continue to shape the digital landscape.

Price Overview

Meanwhile, SOL fell victim to the overall trend seen in the cryptocurrency market over the past 24 hours. According to data from the cryptocurrency price tracking website, CoinStats, SOL’s price had fallen 2.04% throughout the past day of trading. Consequently, the cryptocurrency was changing hands at $23.58 at press time.

During the same period, the global cryptocurrency market capitalization dropped 0.43%. As a result, the market’s valuation was estimated to be $1,127,291,968,913. Interestingly, SOL was still one of the best performers over the past 7 days. CoinStats data indicated that the Ethereum-killer’s weekly performance remained entrenched in the green zone at +24.62% at press time. This ranked it as the second best weekly performer. The only cryptocurrency to outperform SOL during this period was Rollbit Coin (RLB) with its impressive 45.15% gain in price during the past week.

SOL’s performance over the last 2 weeks as well as the previous 30 days were also both in the green. At press time, SOL’s price was up 18% throughout the past fortnight, while its monthly performance stood at around 21%.

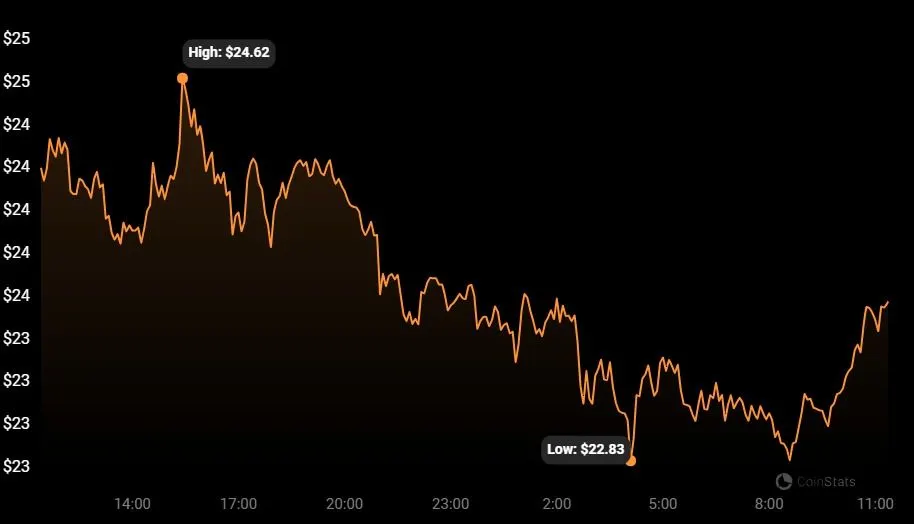

Price chart for SOL (Source: CoinStats)

From a shorter time frame perspective, SOL not only weakened against the dollar over the past 24 hours, but had displayed a similar performance against the market leader Bitcoin (BTC) as well. CoinStats showed that SOL was down 2.29% against the leading cryptocurrency. As a result, 1 SOL token was estimated to be worth 0.00085565 BTC. Furthermore, the altcoin was trading slightly closer to its 24-hour low of $22.83 at press time, while the cryptocurrency was able to establish a peak at $24.62 during the past day of trading.