The head of research for a leading digital assets manager says one catalyst could cause Bitcoin (BTC) to soar to more than $265,000.

In a new blog post, CoinShares head of research James Butterfill shares his calculations of a potential price impact if a spot BTC exchange-traded fund (ETF) is approved by the U.S. Securities and Exchange Commission (SEC).

He says that the ETF financial product would attract a large influx of institutional money, some portion of an estimated $48.3 trillion addressable assets in the United States.

“One could assume that perhaps 10% invest in a spot Bitcoin ETF with an average allocation of 1%, which would equate to $14.4 billion of inflows in the first year…

There does seem to be a relationship between inflows as a percentage of AUM (assets under management) and change in [BTC] price…

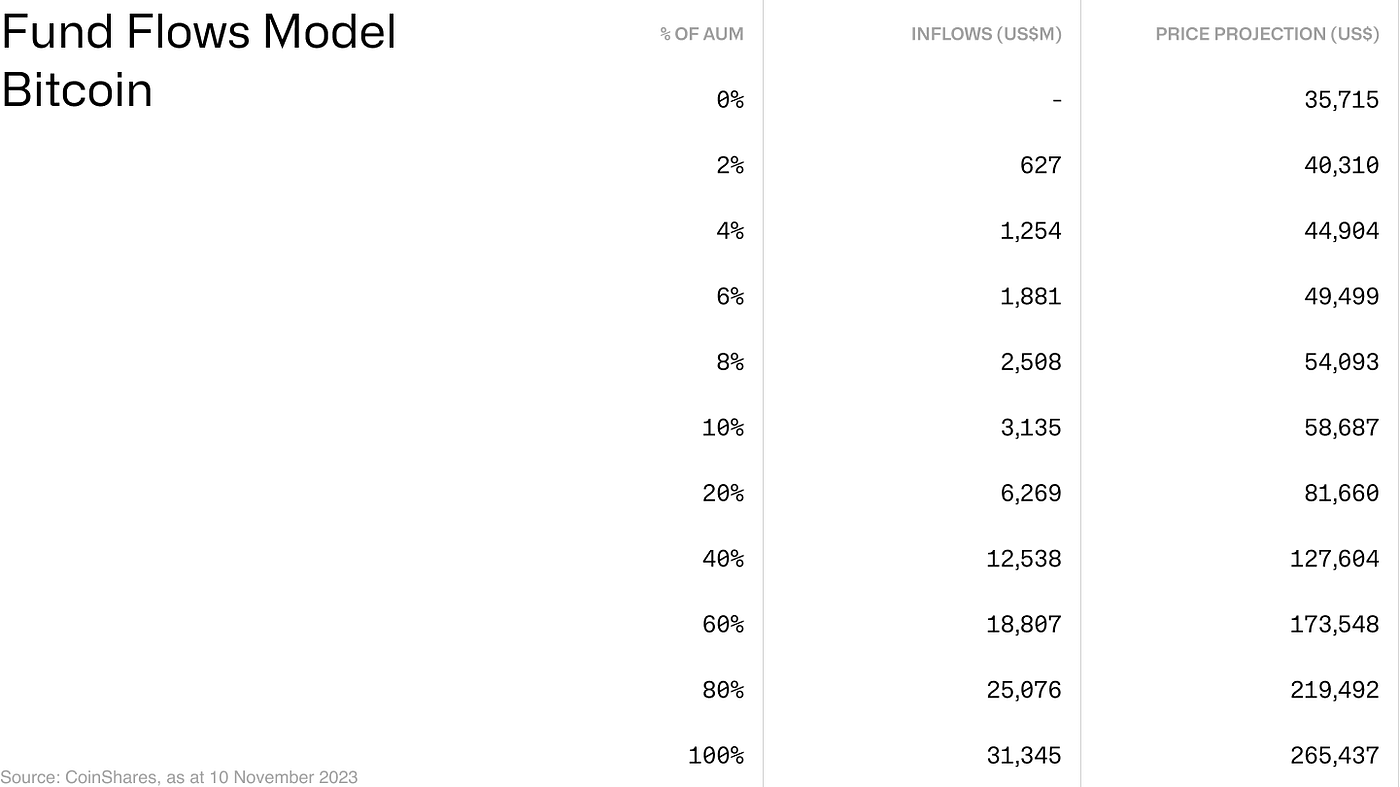

If we take the aforementioned $14.4 billion of inflows, the model suggests it could push the price up to $141,000 per Bitcoin. The problem with the estimate of inflows is that it is very difficult to ascertain exactly how much inflows there will be when the spot ETFs are launched. Below is a simple matrix with a varied set of inflows, and its potential impact on the Bitcoin price.”

Looking at his chart, his analysis shows that if the inflow was $31.3 billion then Bitcoin could soar to $265,437, a more than 627% increase from its current value of $36,475 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: DALLE3