Catching up with the latest from the financial world is an important part of staying up-to-date with market trends, economic changes, and openings for investment. Enter Wirex and Visa, a match made in heaven for those looking to revolutionize digital transaction processing.

The Power of Partnership

Wirex is recognized for its cutting-edge Web3 money app, while Visa has been a front-runner in digital payments worldwide. Their joint objective, according to their recent announcement, is to further the development of digital currencies across the UK and the European Economic Area to make smooth and assured digital payments.

This partnership represents a landmark in solutions for the global movement of funds, ensuring seamless transactions and efficient monetary movement between crypto and conventional fiat currencies.

Why This Partnership Matters

Merging Visa’s trusted payment network with Wirex’s innovative products ensures the seamless management of cryptos and traditional currencies, maintaining fast and efficient transactions. Moreover, Visa’s licensing of Wirex for card issuance and its principal membership in the Visa Network further exemplify Wirex’s pioneering role in the financial services sector.

Cuy Sheffield, Head of Crypto at Visa, said, “Partnering with Wirex to help integrate blockchain technology with traditional finance, including the launch of Wirex Pay, aligns closely with our vision for the future of payments while highlighting the importance of collaboration in driving fintech innovation.”

Introducing Wirex Pay

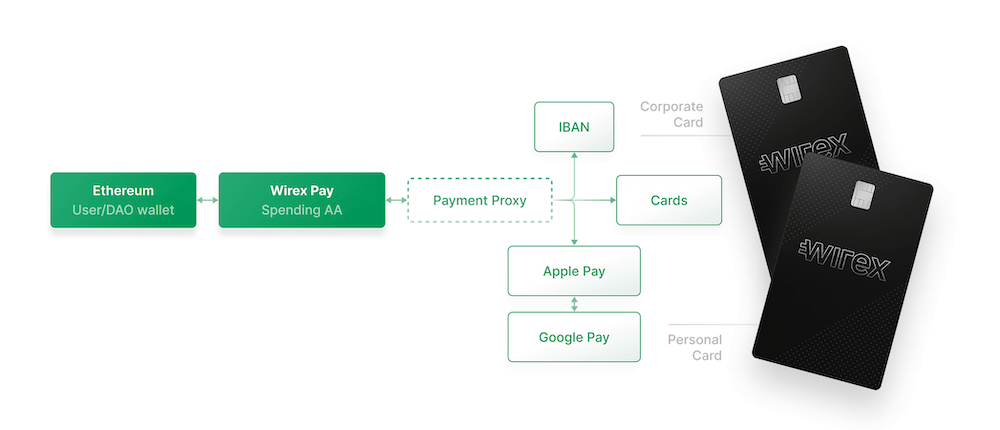

One of the most exciting deliverables from this partnership is the launch of Wirex Pay. This modular Zero Knowledge (ZK) payment chain pioneers a new way to manage and spend both digital and traditional money. It is designed for robust solutions for global funds movement, making transactions effective and user-friendly.

One of the very few fintechs licensed by Visa to issue cards, Wirex Pay underscores the potential of the fintech arena to bridge the gap between blockchain technology and traditional finance.

As a licensed Visa crypto-native firm, Wirex paves the way for the creation of a whole array of solutions for moving money on a global scale—this is the base of a financial world transitioning into Web3 and decentralization.

Ease of financial transactions is just one part; obviously, it will result in smoother and more effective financial interactions. This could be a game-changer for someone wanting to integrate crypto into their lifestyle.

Conclusion

Wirex can use Visa’s principal license, making a seamless transaction between blockchain technology and traditional finance possible. It offers users secure accounts to hold, transfer, and exchange currencies.

This gives Wirex the unique ability to define emerging trends within Web3 and take the first step in bringing mainstream access to digital finance and wealth management by being a principal member of both Visa and Mastercard.