The cryptocurrency market has endured a significant downturn that wiped around $300 billion from its total market capitalization amid a wider sell-off in risk assets after the Federal Reserve cut interest rates by 25 basis points and signaled a more hawkish stance.

The Federal Reserve’s Chair, Jerome Powell, pointed to a potential easing of interest rate cutting in the next year, which impacted investor sentiment across risk assets and briefly saw the price of Bitcoin below $100,000, with the cryptocurrency now trading at $99,500.

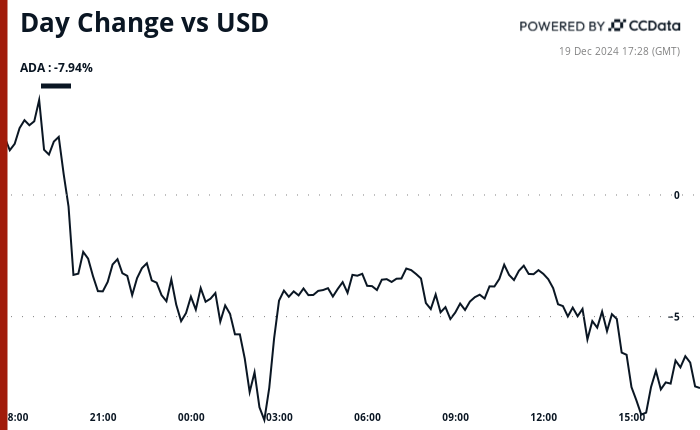

Similarly, the price of Ethereum’s ether plunged from around $4,000 to now stand around the $3,550 mark after losing more than 8% of its value. Cardano’s native token ADA wasn’t unaffected and plunged around 7.9% over the last 24-hour period, from around $1.01 to $0.93 at the time of writing.

As CryptoGlobe reported, whales on the Cardano ecosystem took advantage of the recent cryptocurrency market dip to keep accumulating, after realizing some of their gains when the price surpassed the $1.15 mark earlier this month.

According to data shared by popular cryptocurrency analyst Ali Martinez, when Cardano traded between $1.15 and $1.33, Cardano whales sold their tokens to realize their gains before the price of the cryptocurrency dipped.

As it moved to $0.91, they took advantage of the dip to keep accumulating. Per Martinez, whales added 160 million ADA tokens since the price of the cryptocurrency dropped.

The price of Cardano surged more than 180% since early November, moving from around $0.36 per token to now stand at $0.927. Several catalysts helped the cryptocurrency surge, including Republican presidential candidate Donald Trump winning the U.S. elections after campaigning on a pro-crypto stance.

Featured image via Unsplash.