- Volumes across major exchanges like Binance and OKX continued to be lackluster.

- Implied volatility plunged, while the derivatives market also had very little to celebrate.

The crypto market continued to underperform in September, with key indicators like volumes, volatility, and Open Interest (OI) remaining subdued throughout the month.

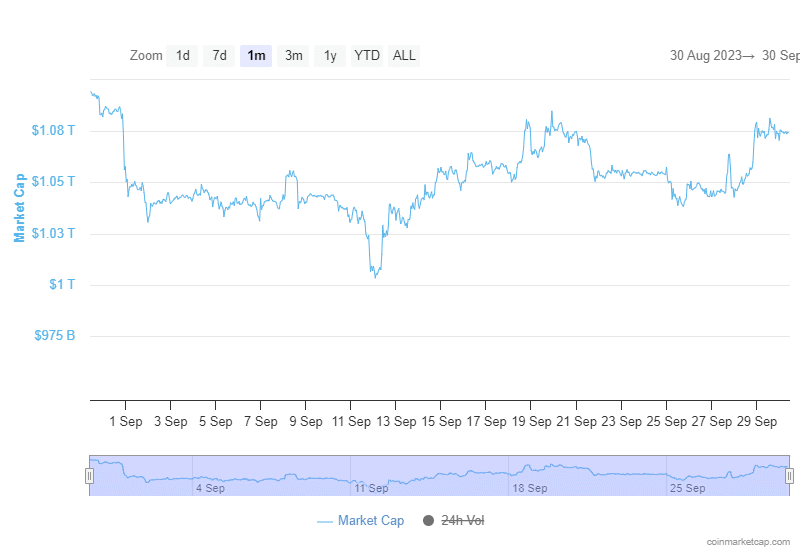

The total cryptocurrency market cap fell by 1.8% over the past month, data from CoinMarketCap showed, as bellwethers like Bitcoin [BTC] and Ethereum [ETH] traversed in tight trading ranges.

Source: CoinMarketCap

Indeed, the king coin oscillated between $25,900 and $27,200 for most parts while ETH was stuck in the $1,600-region. The muted price action turned traders away from crypto trading platforms.

Lull in spot, derivatives markets

According to digital asset research firm Reflexivity Research, volumes across major exchanges like Binance [BNB] and OKX continued to be lackluster. This was in stark contrast to the previous years, when traders frequently flipped their holdings for quick profits.

Source: Reflexivity Research

Notably, liquid supply of Bitcoin and Ethereum sank further in September, as demonstrated by data from Glassnode. Dwindling faith in the stability of exchanges, along with more lucrative use cases such as staking and long-term HODLing, drove traders to self-custody.

Source: Glassnode

Moreover, once infamous for its untamed price swings, the crypto market surprisingly entered into a period of hibernation. Bitcoin’s 1-month realized volatility drifted lower in September, coinciding with the drop in the asset’s value.

While the historical volatility plunged, the implied or forward-looking volatility also reflected the overall gloom in the market. Deribit’s implied volatility index declined in September, signaling that the market would continue to be less active in the near future.

Consequently, expectations of a meaningful rise in price plummeted.

Derivatives markets hold a lot of significance for digital assets. This is because, by the very nature, cryptos are speculative and seasoned traders look to profit from potential rises and falls in value.

The Open Interest (OI), which measures the amount of money invested in derivatives at any given time, is a useful metric to analyze this market. The OI tracks the number of active positions in the market, be it longs or shorts.

According to Reflexivity Research, the dollar value locked in Bitcoin’s unsettled contracts on futures exchanges continued its slide in September.

Notably, the futures market was yet to recover from the shocks dealt in the last month, when billions of dollars in OI were wiped out in the biggest crypto market crash of 2023.

Source: Reflexivity Research

U.S. no longer boosting Bitcoin’s value

Another fascinating finding which came to light was the underwhelming performance of the U.S. market. The analysis revealed that during late Q2 and early Q3, the cumulative return of Bitcoin in U.S. trading hours outperformed that of Europe and Asia-Pacific (APAC).

Source: Reflexivity Research

However, as Q3 progressed, U.S. bids for Bitcoin in particular, and cryptos in general, fell drastically. In fact, the cumulative returns from the global economic giant dipped below those of the APAC region.

The state of Grayscale Bitcoin Trust

Meanwhile, crypto investment behemoth Grayscale Bitcoin Trust (GBTC) saw a spike in the discount to its underlying Bitcoin holdings over the past month. At the time of writing, the discount was 20.74%, as per YCharts.

However, on a year-to-date basis, significant improvements were seen. Recall that the discount to net asset value NAV had expanded to about 50% late last year and spent much of 2023 in a range around 40%.

Source: Reflexivity Research

Typically, when the discount narrows, it implies that investors are becoming more confident in the trust.

Grayscale has attempted to convert its trust into a spot Bitcoin ETF, but has been rejected by the U.S. Securities and Exchange Commission (SEC). However, a recent court verdict directed the SEC to review its decision, spurring hopes of an approval in the near future.

SEC has until 13 October to appeal the Grayscale case decision.

The shining spots

Although leading crypto assets didn’t evoke much optimism, there were some oases of growth. Altcoins such as MakerDAO [ MKR] and Chainlink [LINK] were the top two best-performing cryptos over the last months, with impressive gains of 36% and 35% respectively.

While MKR benefitted from the real-world assets (RWA) narrative, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) expansion provided the boost to the native token.