- Bitcoin might begin another bull rally before its upcoming halving.

- Metrics and indicators supported the possibility of a bull run.

Bitcoin’s [BTC] price finally showed signs of a bull rally after days of being in a consolidation phase. The king of cryptos’ price action turned bullish at a time when it was expecting its next halving just in a few days.

Bitcoin turns volatile

After several days of sluggish price movement, BTC bulls recently made a move, allowing the king of cryptos to register gains.

According to CoinMarketCap, Bitcoin was up by more than 2% in the last 24 hours, helping it inch towards $70k.

At the time of writing, BTC was trading at $69,497.75 with a market capitalization of over $1.37 trillion.

The hike in price stirred up expectations from the coin, and for investors, the possibility of BTC touching its previous ATH of $73k again seemed likely to happen.

In fact, Mags, a popular crypto analyst, recently posted a tweet mentioning that BTC’s first half of the bull rally was over, and it was about to begin its second innings.

If that’s true, then the BTC might as well reach a new ATH before its upcoming halving. As per the tweet, BTC’s ATH might be somewhere near $350k.

What the metrics suggest

Since the target of $350k looked pretty ambitious, AMBCrypto planned to take a look at the king of crypto’s metrics to see what to expect in the near term.

Our analysis of CryptoQuant’s data revealed that its exchange reserve was decreasing, meaning the buying pressure on the coin was high.

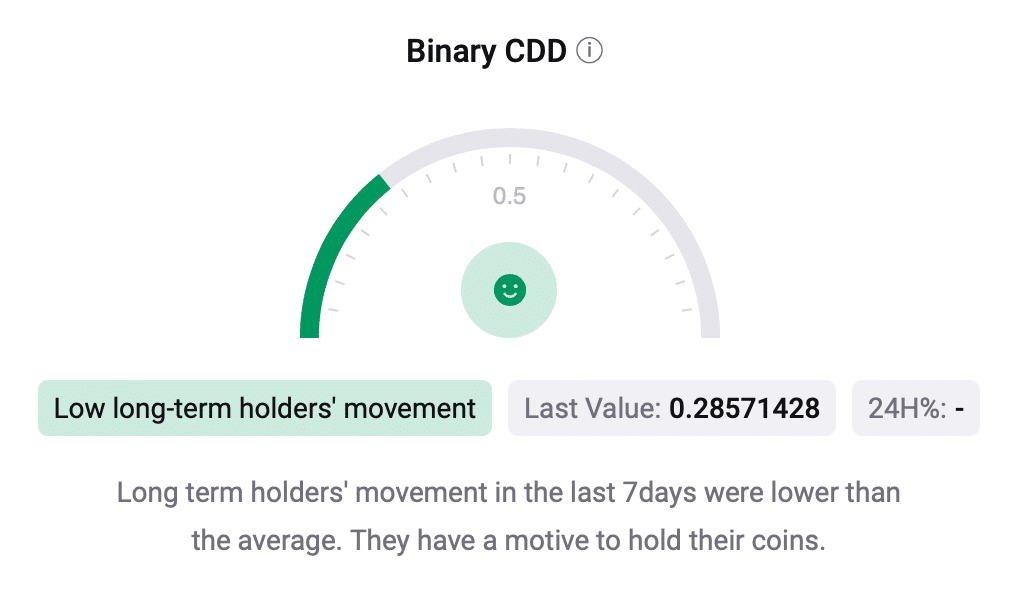

Its Binary CDD was green as well, meaning that long-term holders’ movements in the last seven days were lower than average.

Source: CryptoQuant

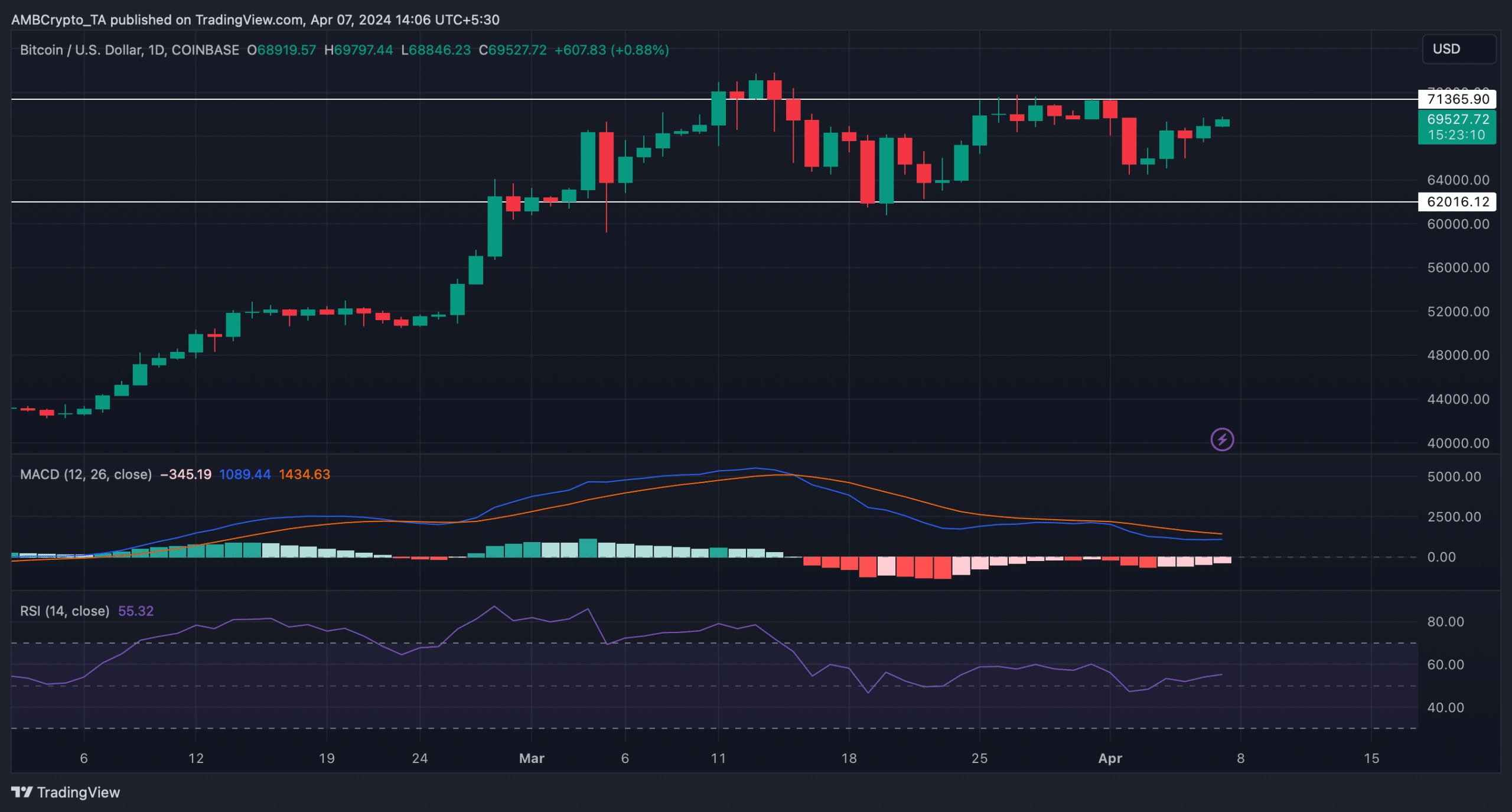

AMBCrypto then analyzed BTC’s daily chart to see whether an uptrend was inevitable. We found that BTC needs to go above the $71k resistance in order to initiate a bull rally.

The possibility of this happening was likely, as the Relative Strength Index (RSI) registered an uptick. However, nothing can be said with certainty, as the MACD displayed a bearish advantage in the market.

Source: TradingView

A quick look at the upcoming halving

All of this was happening at a time when BTC was expecting its next halving, which is about to happen in around 12 days from press time.

The halving will gradually reduce the available supply for trade over the next four years, with an estimated impact of ~6%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

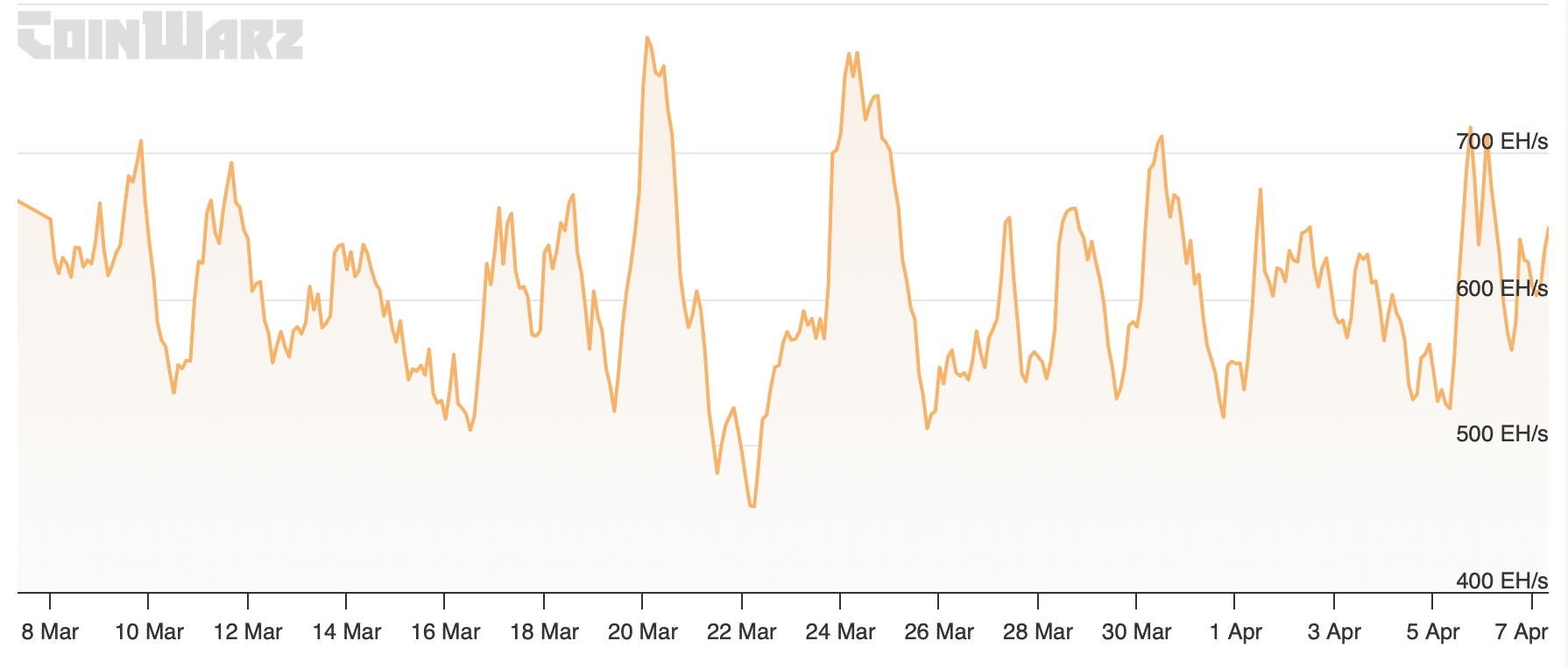

AMBCrypto then took a look at BTC’s mining sector to see how miners were behaving before the halving.

We found that BTC’s hashrate remained relatively high last month, reflecting a stable number of miners operating in the ecosystem. At press time, BTC’s hashrate stood at 656.61 EH/s.

Source: Coinwarz