The co-founders of the crypto analytics firm Glassnode believe that a Bitcoin (BTC) bottom could form after one of two things occur following the market downturn.

Glassnode co-founders Jan Happel and Yann Allemann, who share the Negentropic handle, tell their 56,000 X followers that they are looking at two scenarios where Bitcoin could carve a local bottom.

According to Happel and Allemann, Bitcoin could either gradually drop to the $25,000 range or witness a severe liquidation event before bottoming out.

“Bitcoin Risk Signal at 100.

Two possible short-term scenarios:

1. Slow bleed to $24,800-$25,000.

2. Fast, aggressive wick that gets bought up fast. Either way, we’ll bottom out shortly after one plays out. We’ve seen these two scenarios play out in the past whenever the BTC Risk Signal has hit 100.”

Looking at the analysts’ chart, it appears that BTC tends to witness a corrective move when the Risk Signal hits 100.

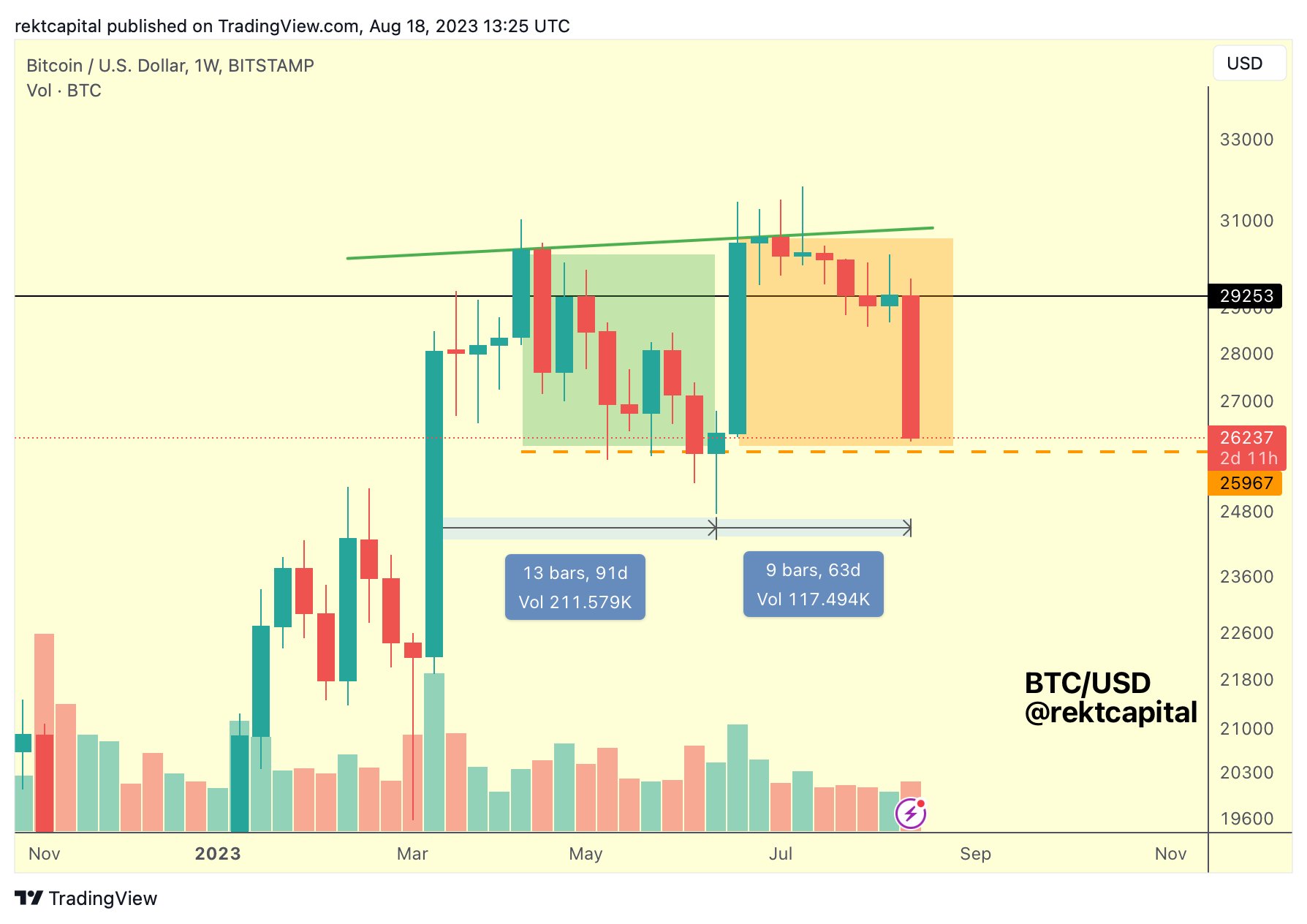

Pseudonymous crypto strategist Rekt Capital is also weighing in on BTC. According to the analyst, Bitcoin looks weak after printing a bearish double-top pattern.

“It took BTC 91 days to form the first half of the double top.

And only 63 days to form the second half of the double top.

What’s the takeaway?

The first half dropped in price in a step-by-step manner, respecting supports but ultimately breaking them (green box).

This recent crash didn’t care about any supports on the way down (orange box).

There was no reaction whatsoever

Just shows how weak the buy-side pressure is around the orange-boxed region.

Buys aren’t ready or strong enough to properly step in and change the course of price action.

And current volume levels suggest seller pressure hasn’t even reached its peak yet.”

Bitcoin is trading for $26,028 at time of writing, down 2.3% in the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Generated Image: Midjourney